dYdX Staking Programme

In 2025, DeFi is witnessing a trend of applications moving towards the “Fat App Thesis” – the theory that killer apps will lead future market cycles by owning their own full stack. But this idea is far from new.

dYdX was perhaps the earliest example of a leading DeFi app capitalising on a popular product and strong community to build their own infrastructure, after moving first to StarkWare in 2021, and then setting up dYdX Chain in 2023.

The challenge then became translating dYdX’s killer app into a complete ecosystem, capable of delivering utility, security and growth opportunities. This would require alignment among the chain’s stakeholders, and a clear value proposition for its participants. That’s where kpk stepped in.

In this case study, we explore how dYdX mobilised its treasury to help secure its chain, grow protocol revenue, and put the Fat App Thesis into practice.

We explain how ~65 million DYDX has been deployed across 42 validators, how rewards are now channeled into buybacks and staking, and how active management of treasury assets is supporting the ecosystem’s sustainable growth. It’s a model that’s turning dYdX from a high-performing app into a sovereign DeFi ecosystem.

Mobilising The Treasury

dYdX was the first protocol to prove that decentralised perpetual futures can meaningfully compete with centralised exchanges. By pioneering the category, it helped legitimise DeFi among professional traders and established onchain trading a credible pillar in their liquidity stack.

As DeFi matured, dYdX doubled down on this vision. In 2023, they launched their own chain to enable greater control over performance, economics, and sovereignty — putting the Fat App Thesis into practice: the idea that the most impactful applications will naturally come to own their entire stack.

Fast forward to September 2024, the question shifted to how best to leverage their resources and reputation to utilise the Fat App’s treasury and galvanise a financial flywheel.

To kick things off, kpk charted a plan to mobilise part of the dYdX DAO treasury by forming a new Treasury subDAO and embarking on a structured staking programme deploying a large allocation of DYDX tokens on behalf of the dYdX Community and dYdX Operations subDAO (the “Staking Programme”). Our goal was to use active onchain asset management to drive sustainability and growth for the project, improving protocol performance and accruing value to its stakeholders.

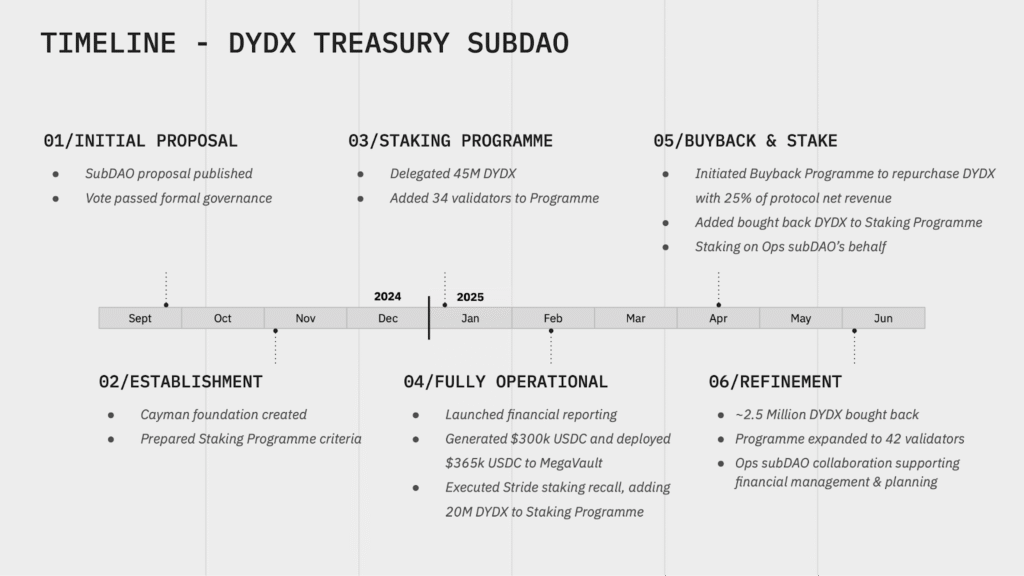

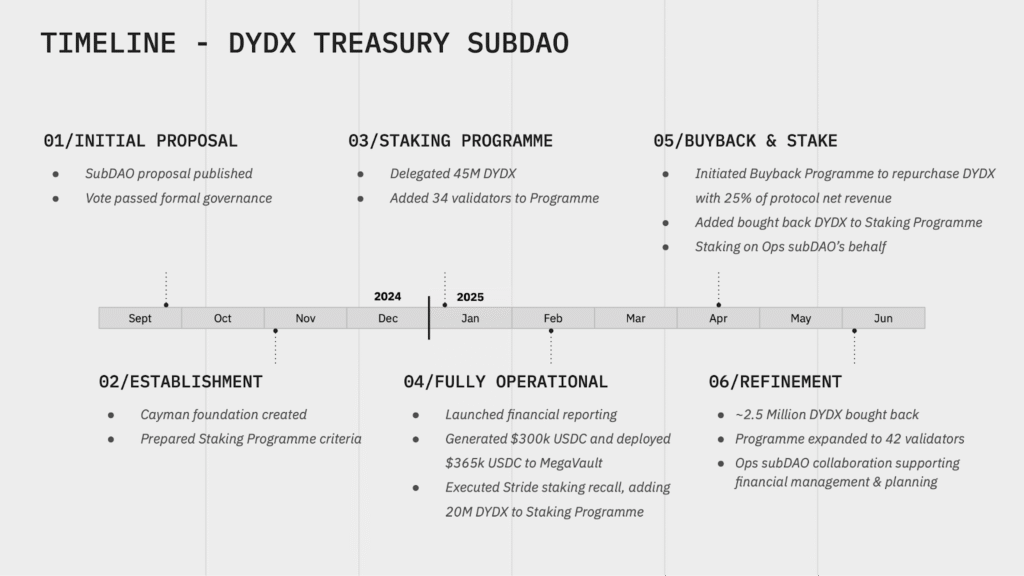

Timeline of key events for the dYdX Treasury SubDAO

By early 2025, we had established a new Cayman Islands foundation for the SubDAO, defined criteria for our Staking Programme, and completed the delegation of 45 million DYDX tokens across 34 qualifying validators. In its first month, the programme generated ~$365,000 USDC for the DAO, while strengthening validator participation through aligned incentives.

Over time our efforts expanded. We recalled the dYdX Community Stride delegation and added 20 million DYDX tokens to the programme, and grew the delegation to 42 qualifying validators. We also obtained approval to redeploy the proceeds into yield-generating opportunities, like the MegaVault. Finally, we spearheaded a new buyback & stake programme which allocated 25% of protocol net revenue to repurchase DYDX tokens for further staking.

The results speak for themselves…

Secure Staking

The importance of an effective staking system for PoS blockchains cannot be overstated. It’s about more than securing the chain’s transactions: it’s the anchor for stabilising economic relationships across users, contributors and validators.

For participating validators, dYdX’s Staking Programme has strengthened the value proposition: offering large-scale and reliable delegations as a base incentive for participation, as well as an effective means of coordination across the validator network. This lowers the upfront risk and barriers to entry for validators, fostering long-term alignment to help secure dYdX Chain. The Staking Programme has contributed to a ~48.7% increase in total DYDX staked across the network over the last 12 months, to ~270 million DYDX staked in total at the end of May 2025.

The feedback from validators has been extremely positive:

Quote from Cosmostation, a qualifying dYdX Chain Validator for the Staking Programme

The Staking Programme has become a vector for cross-DAO coordination. For example, the Operations SubDAO deployed ~14 million DYDX into the Staking Programme in March, seeking to optimise idle funds allocated to its mandate over the next 2-3 years. Despite the different objectives of each subDAO, close collaboration between Treasury and Ops via the Staking Programme has supported their shared efforts around sustainability, growth and network security.

The Staking Programme’s impact on coordination for both validators and the DAO has been a clear driver of improved protocol performance. But equally impressive is its impact on dYdX’s growing DeFi ecosystem and the alignment of DYDX tokenholders with the success of the dYdX protocol.

Value Accrual

The hidden strength of the Staking Programme has been the new opportunities it has created for developing and expanding the DYDX token economics and value accrual mechanisms for the ecosystem’s stakeholders.

In February, we proposed the addition of the Buyback and Stake component, where 25% of net dYdX protocol revenue would be used to repurchase DYDX tokens for addition to the Staking Programme. This creates a constant upwards pressure on the Staking Programme’s size and buying pressure on DYDX token. As of late June, the programme had bought back ~2.5 million DYDX, at a market value of ~$1.2 million. A comprehensive Buyback Tracker keeps track of the progress in real time.

For DYDX tokenholders, this strengthens the link between the dYdX exchange, the DYDX token, and the dYdX Chain (where value accrues back to DYDX tokenholders that participate in staking). These mechanics enhance the economic rationale for DYDX tokenholders to participate in staking and contribute to network security.

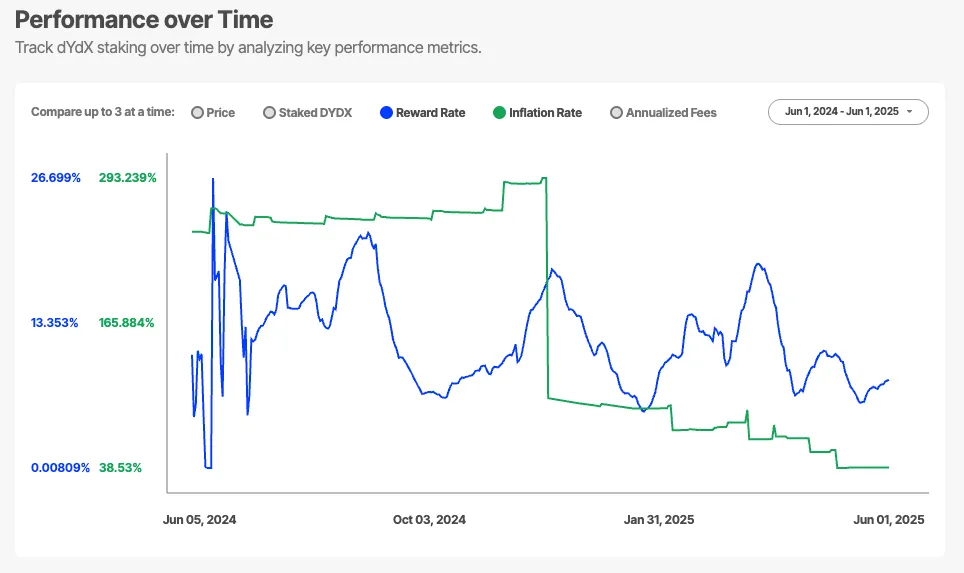

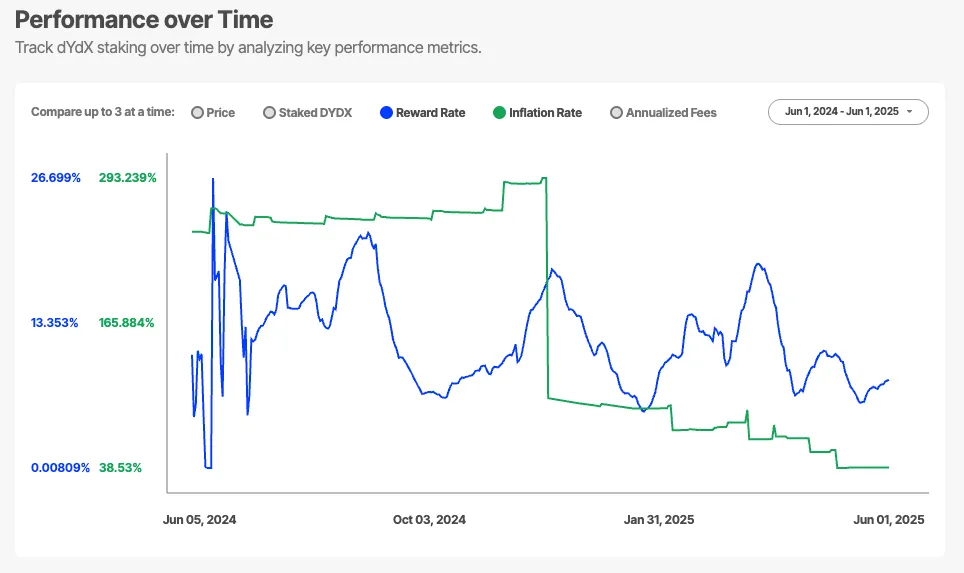

It also offsets any permitted inflation or sale pressure by removing more DYDX from the market. This has had both an immediate and ongoing impact, consistently closing the gap between the staking reward rate and the inflation rate:

Graph contrasting dYdX Chain staking reward rate versus DYDX token inflation rate. Source: stakingrewards.com.

At the same time, the dYdX community has focused its attention on stimulating activity through rewards paid out in DYDX. Trading campaigns like the dYdX Surge are accelerating the pace of token distribution across the network, meaning more users than ever are receiving the token and witnessing the benefits of this value accrual. This in turn is driving further increases in staking from ~29% of supply staked before the dYdX Surge Programme began in April to ~36% staked now, as well as incentives to continue trading on dYdX.

Together, these elements are reinforcing a positive feedback loop between activity, incentives, and participation.

Theory in Action

dYdX is a strong example of the Fat App Thesis in action. In a market where blockspace vastly outnumbers calldata, dYdX has proven that new chains can compete and reach traction by building around a strong app and community. The Treasury subDAO has provided a vehicle for translating fresh activity at the protocol level into meaningful DeFi ecosystem growth.

Our work here is far from done. With the concept now proven and yields flowing back into the treasury, there is increasing bandwidth for new initiatives and improved sustainability. The remaining half of the DAO treasury, which sits undeployed, could offer further opportunities to support ecosystem development.

Whatever the future holds, dYdX has pioneered the pathway for ecosystems led by killer apps. Now, as others hurry to adopt a similar model, we’re beginning to understand what factors make the difference in converting a good DeFi app into a great onchain ecosystem.

Gnosis Pay Rewards: Under The Hood

A technical look at the infrastructure powering Gnosis Pay Rewards—custom on-chain indexing, safe address resolution, and automated distributions—turning a simple user flow into a scalable, predictable system.

Onchain Investment Vehicles: Open Finance’s Connective Tissue

kpk is building open finance’s connective tissue: onchain investment vehicles that put NAVs and controls on-chain, standardise flows and route liquidity across venues—unlocking programmable, compliant products for institutions, builders and treasuries.

The 21Shares dYdX ETP: Beyond The Boundaries

The 21Shares dYdX ETP connects institutional and retail brokerage accounts to dYdX through a regulated, exchange-listed vehicle. We break down what an ETP is, the significance for dYdX and DeFi, and why listed products can push adoption “beyond the boundaries.

dYdX Staking Programme

In 2025, DeFi is witnessing a trend of applications moving towards the “Fat App Thesis” – the theory that killer apps will lead future market cycles by owning their own full stack. But this idea is far from new.

dYdX was perhaps the earliest example of a leading DeFi app capitalising on a popular product and strong community to build their own infrastructure, after moving first to StarkWare in 2021, and then setting up dYdX Chain in 2023.

The challenge then became translating dYdX’s killer app into a complete ecosystem, capable of delivering utility, security and growth opportunities. This would require alignment among the chain’s stakeholders, and a clear value proposition for its participants. That’s where kpk stepped in.

In this case study, we explore how dYdX mobilised its treasury to help secure its chain, grow protocol revenue, and put the Fat App Thesis into practice.

We explain how ~65 million DYDX has been deployed across 42 validators, how rewards are now channeled into buybacks and staking, and how active management of treasury assets is supporting the ecosystem’s sustainable growth. It’s a model that’s turning dYdX from a high-performing app into a sovereign DeFi ecosystem.

Mobilising The Treasury

dYdX was the first protocol to prove that decentralised perpetual futures can meaningfully compete with centralised exchanges. By pioneering the category, it helped legitimise DeFi among professional traders and established onchain trading a credible pillar in their liquidity stack.

As DeFi matured, dYdX doubled down on this vision. In 2023, they launched their own chain to enable greater control over performance, economics, and sovereignty — putting the Fat App Thesis into practice: the idea that the most impactful applications will naturally come to own their entire stack.

Fast forward to September 2024, the question shifted to how best to leverage their resources and reputation to utilise the Fat App’s treasury and galvanise a financial flywheel.

To kick things off, kpk charted a plan to mobilise part of the dYdX DAO treasury by forming a new Treasury subDAO and embarking on a structured staking programme deploying a large allocation of DYDX tokens on behalf of the dYdX Community and dYdX Operations subDAO (the “Staking Programme”). Our goal was to use active onchain asset management to drive sustainability and growth for the project, improving protocol performance and accruing value to its stakeholders.

Timeline of key events for the dYdX Treasury SubDAO

By early 2025, we had established a new Cayman Islands foundation for the SubDAO, defined criteria for our Staking Programme, and completed the delegation of 45 million DYDX tokens across 34 qualifying validators. In its first month, the programme generated ~$365,000 USDC for the DAO, while strengthening validator participation through aligned incentives.

Over time our efforts expanded. We recalled the dYdX Community Stride delegation and added 20 million DYDX tokens to the programme, and grew the delegation to 42 qualifying validators. We also obtained approval to redeploy the proceeds into yield-generating opportunities, like the MegaVault. Finally, we spearheaded a new buyback & stake programme which allocated 25% of protocol net revenue to repurchase DYDX tokens for further staking.

The results speak for themselves…

Secure Staking

The importance of an effective staking system for PoS blockchains cannot be overstated. It’s about more than securing the chain’s transactions: it’s the anchor for stabilising economic relationships across users, contributors and validators.

For participating validators, dYdX’s Staking Programme has strengthened the value proposition: offering large-scale and reliable delegations as a base incentive for participation, as well as an effective means of coordination across the validator network. This lowers the upfront risk and barriers to entry for validators, fostering long-term alignment to help secure dYdX Chain. The Staking Programme has contributed to a ~48.7% increase in total DYDX staked across the network over the last 12 months, to ~270 million DYDX staked in total at the end of May 2025.

The feedback from validators has been extremely positive:

Quote from Cosmostation, a qualifying dYdX Chain Validator for the Staking Programme

The Staking Programme has become a vector for cross-DAO coordination. For example, the Operations SubDAO deployed ~14 million DYDX into the Staking Programme in March, seeking to optimise idle funds allocated to its mandate over the next 2-3 years. Despite the different objectives of each subDAO, close collaboration between Treasury and Ops via the Staking Programme has supported their shared efforts around sustainability, growth and network security.

The Staking Programme’s impact on coordination for both validators and the DAO has been a clear driver of improved protocol performance. But equally impressive is its impact on dYdX’s growing DeFi ecosystem and the alignment of DYDX tokenholders with the success of the dYdX protocol.

Value Accrual

The hidden strength of the Staking Programme has been the new opportunities it has created for developing and expanding the DYDX token economics and value accrual mechanisms for the ecosystem’s stakeholders.

In February, we proposed the addition of the Buyback and Stake component, where 25% of net dYdX protocol revenue would be used to repurchase DYDX tokens for addition to the Staking Programme. This creates a constant upwards pressure on the Staking Programme’s size and buying pressure on DYDX token. As of late June, the programme had bought back ~2.5 million DYDX, at a market value of ~$1.2 million. A comprehensive Buyback Tracker keeps track of the progress in real time.

For DYDX tokenholders, this strengthens the link between the dYdX exchange, the DYDX token, and the dYdX Chain (where value accrues back to DYDX tokenholders that participate in staking). These mechanics enhance the economic rationale for DYDX tokenholders to participate in staking and contribute to network security.

It also offsets any permitted inflation or sale pressure by removing more DYDX from the market. This has had both an immediate and ongoing impact, consistently closing the gap between the staking reward rate and the inflation rate:

Graph contrasting dYdX Chain staking reward rate versus DYDX token inflation rate. Source: stakingrewards.com.

At the same time, the dYdX community has focused its attention on stimulating activity through rewards paid out in DYDX. Trading campaigns like the dYdX Surge are accelerating the pace of token distribution across the network, meaning more users than ever are receiving the token and witnessing the benefits of this value accrual. This in turn is driving further increases in staking from ~29% of supply staked before the dYdX Surge Programme began in April to ~36% staked now, as well as incentives to continue trading on dYdX.

Together, these elements are reinforcing a positive feedback loop between activity, incentives, and participation.

Theory in Action

dYdX is a strong example of the Fat App Thesis in action. In a market where blockspace vastly outnumbers calldata, dYdX has proven that new chains can compete and reach traction by building around a strong app and community. The Treasury subDAO has provided a vehicle for translating fresh activity at the protocol level into meaningful DeFi ecosystem growth.

Our work here is far from done. With the concept now proven and yields flowing back into the treasury, there is increasing bandwidth for new initiatives and improved sustainability. The remaining half of the DAO treasury, which sits undeployed, could offer further opportunities to support ecosystem development.

Whatever the future holds, dYdX has pioneered the pathway for ecosystems led by killer apps. Now, as others hurry to adopt a similar model, we’re beginning to understand what factors make the difference in converting a good DeFi app into a great onchain ecosystem.