Exposure To DeFi

Our Institutional Funds

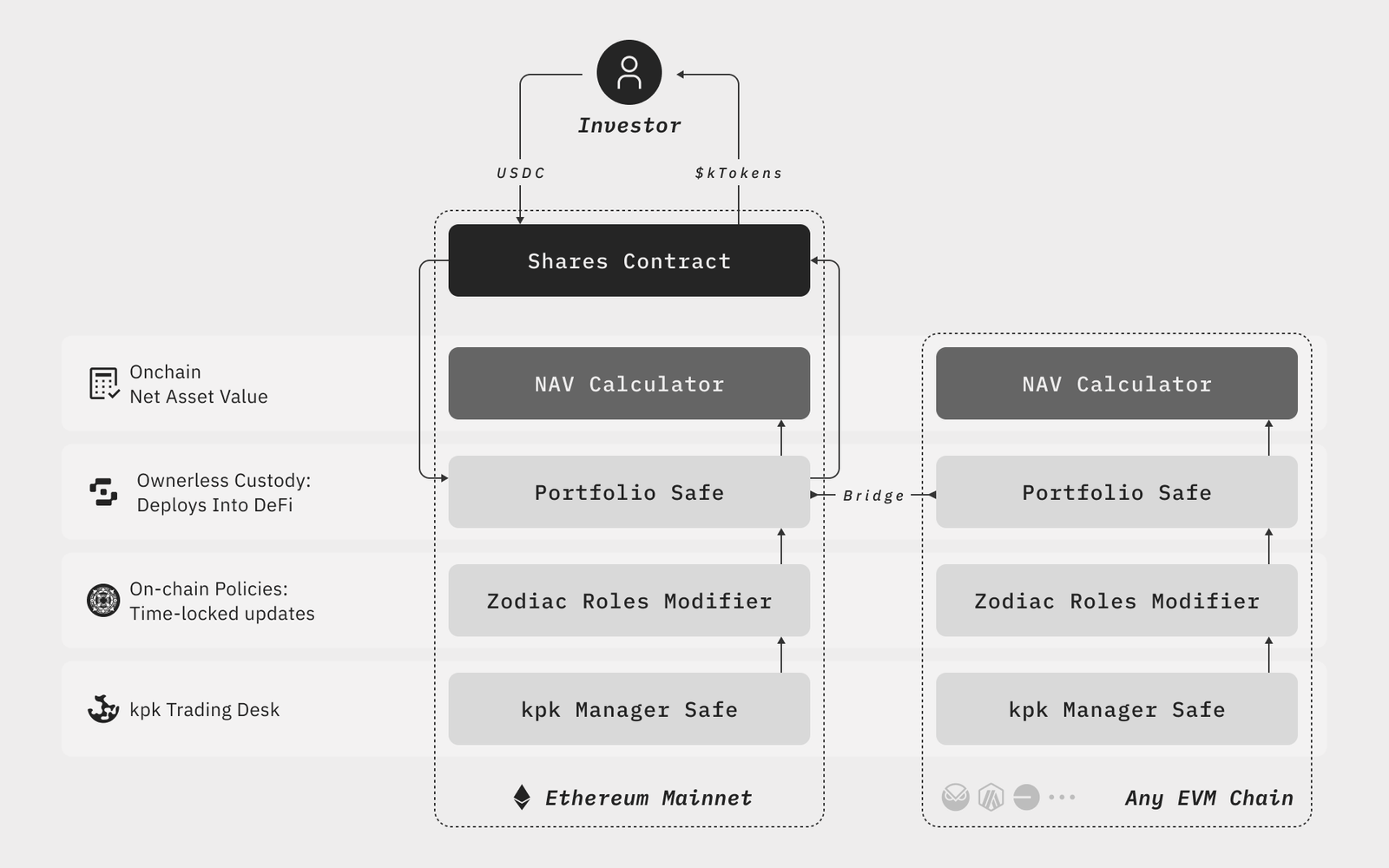

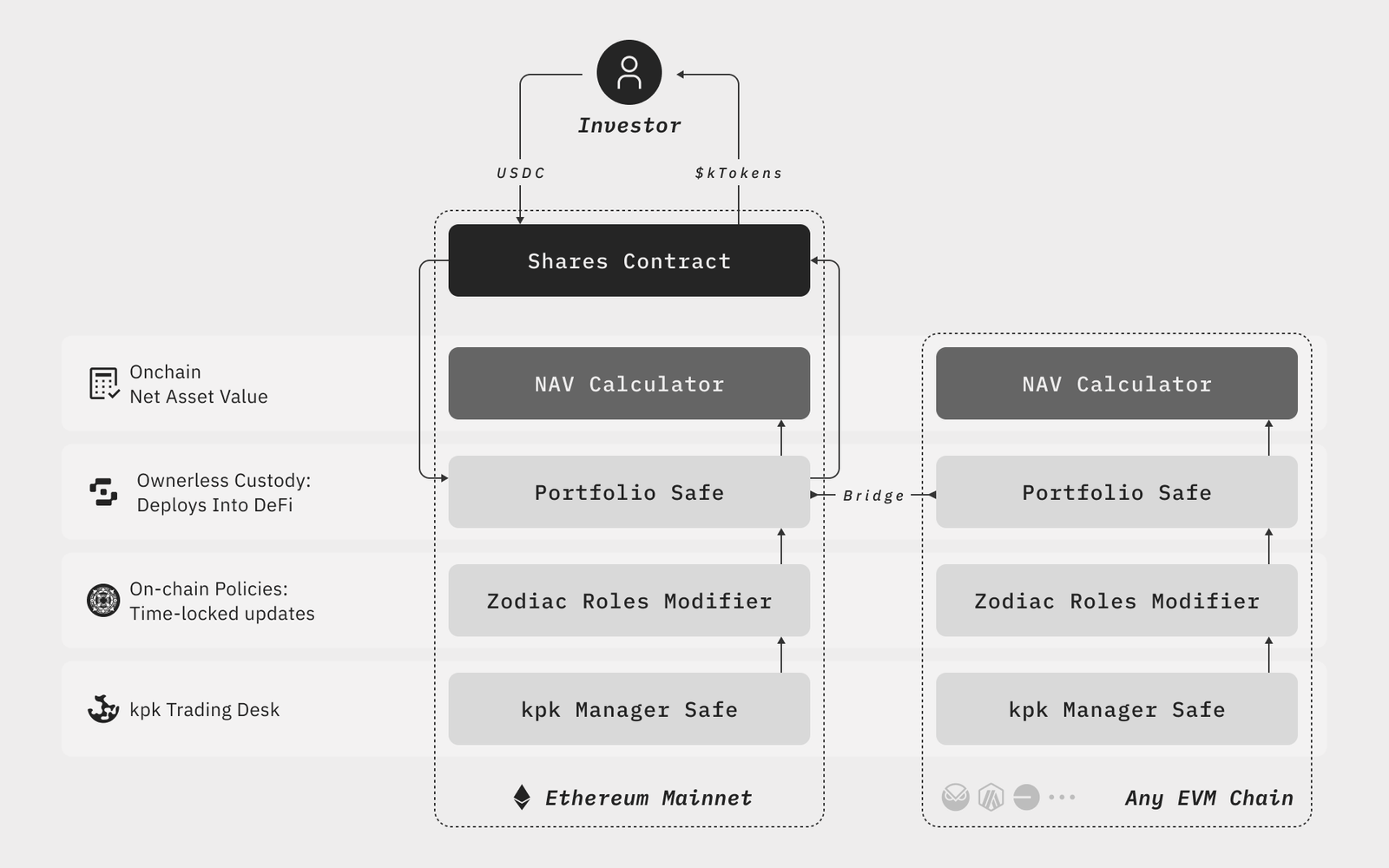

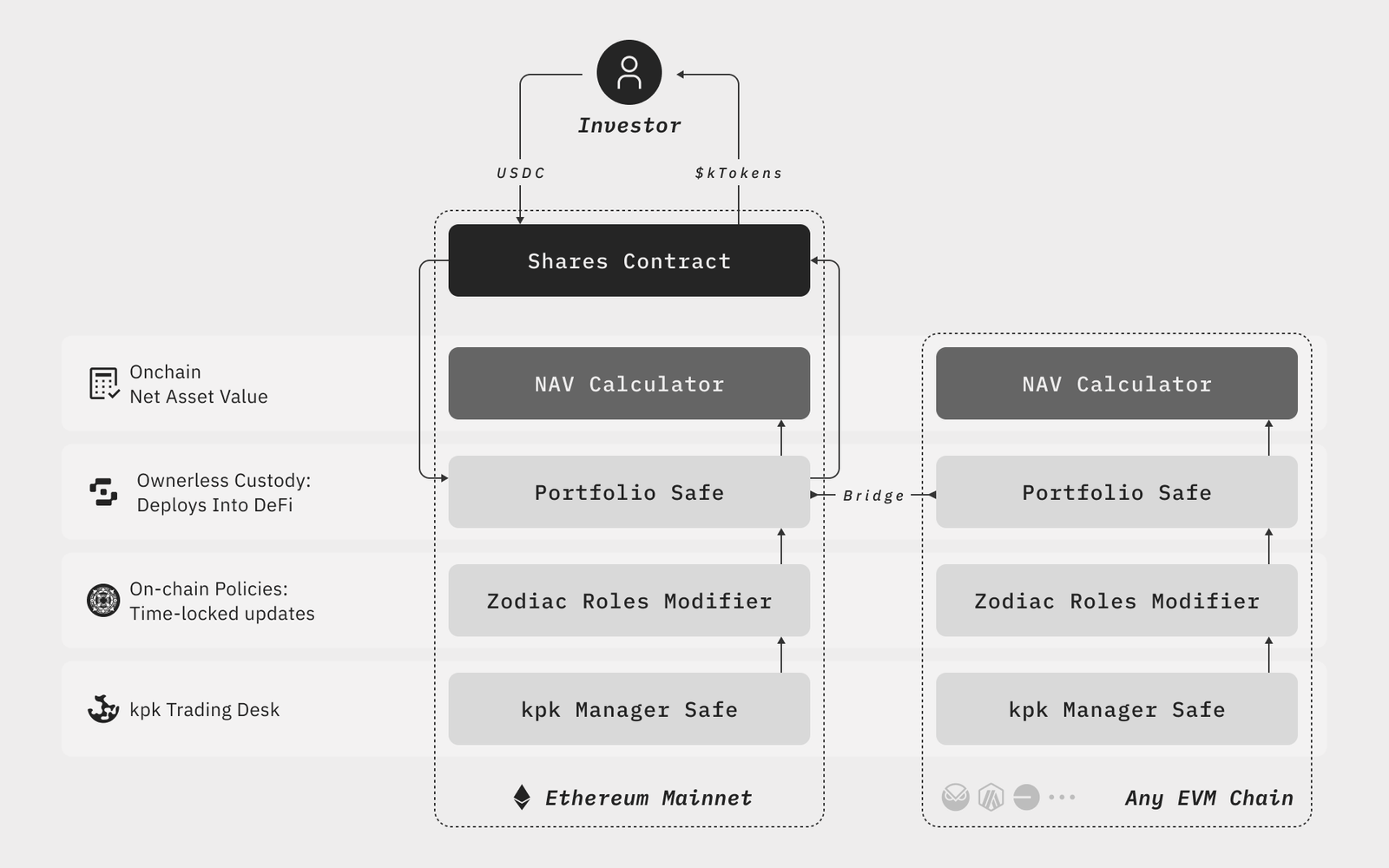

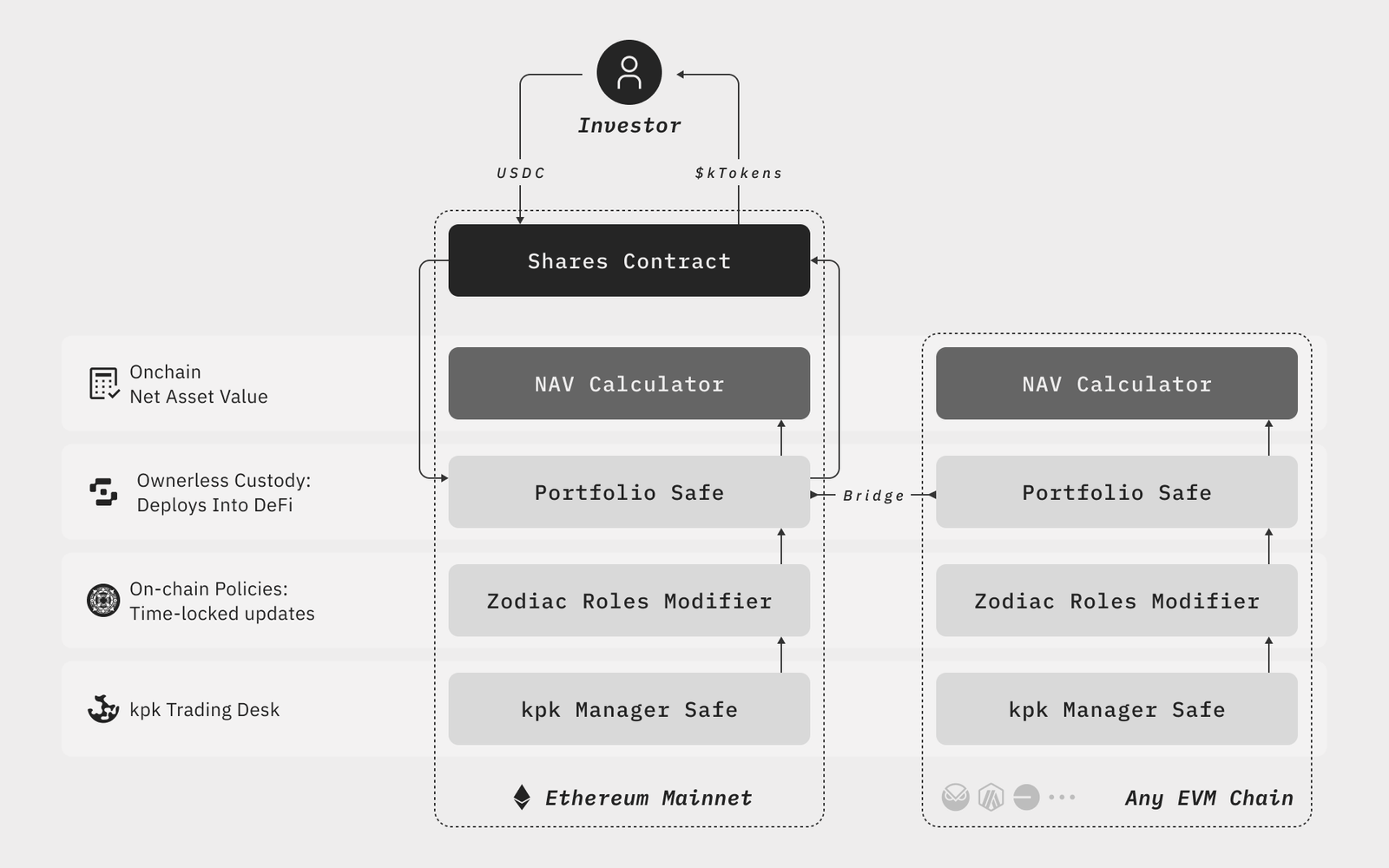

Technology Behind OIVs

Built for Resilient Performance

Diversification

Managed

Actively Managed

Risk Management

Multi-Chain Allocation

Secure Infrastructure

Audits

Contact us for early access or to discuss integration opportunities.

Related Articles

Onchain Investment Vehicles: Open Finance’s Connective Tissue

kpk is building open finance’s connective tissue: onchain investment vehicles that put NAVs and controls on-chain, standardise flows and route liquidity across venues—unlocking programmable, compliant products for institutions, builders and treasuries.

The 21Shares dYdX ETP: Beyond The Boundaries

The 21Shares dYdX ETP connects institutional and retail brokerage accounts to dYdX through a regulated, exchange-listed vehicle. We break down what an ETP is, the significance for dYdX and DeFi, and why listed products can push adoption “beyond the boundaries.

DYDX Staking Programme

Explore how dYdX’s Staking Programme incentivises validators, drives value accrual and accelerates adoption, demonstrating the Fat App Thesis in DeFi.

Exposure To DeFi

Our Institutional Funds

Technology Behind OIVs

Built for Resilient Performance

Managed

Contact us for early access or to discuss integration opportunities

Related Articles

Onchain Investment Vehicles: Open Finance’s Connective Tissue

kpk is building open finance’s connective tissue: onchain investment vehicles that put NAVs and controls on-chain, standardise flows and route liquidity across venues—unlocking programmable, compliant products for institutions, builders and treasuries.

The 21Shares dYdX ETP: Beyond The Boundaries

The 21Shares dYdX ETP connects institutional and retail brokerage accounts to dYdX through a regulated, exchange-listed vehicle. We break down what an ETP is, the significance for dYdX and DeFi, and why listed products can push adoption “beyond the boundaries.

DYDX Staking Programme

Explore how dYdX’s Staking Programme incentivises validators, drives value accrual and accelerates adoption, demonstrating the Fat App Thesis in DeFi.

Our Institutional Funds

Technology Behind OIVs

Built for Resilient Performance

Contact us for early access or to discuss integration opportunities

Related Articles

Our Institutional Funds

Technology Behind OIVs