Towards the Age of Autonomous Vaults

Over the past five years, kpk has managed billions in assets for leading DAOs such as Gnosis and ENS, through a non-custodial infrastructure built for security, scalability, and verifiable execution.

The Onchain Policies (Permissions Layer) at the core of this stack enforce granular controls that eliminate single points of failure and ensure every action remains predictable and transparent.

That same infrastructure now powers kpk’s expansion into the curation market, applying the same discipline of rule-defined, policy-enforced management to agents operating within permissionless environments.

With Gearbox as the first step and Morpho next in line, Vault curation scales kpk’s asset management model by embracing predictable smart contract automation.

To accelerate adoption and reward sustained participation, kpk is also introducing the KPK Rewards Programme, designed to align ecosystem growth, engagement, and transparency through measurable contribution.

Agent-Powered Vaults

kpk vaults on Morpho represent the next stage of automation-centred design. Vault management is fully automated through two dedicated agents operated by kpk. The agents monitor borrow utilisation, APY shifts, price divergence versus reference venues, oracle liveness, and liquidity depth to ensure optimal performance.

These agents are not AI systems but logic-defined programmes that execute whitelisted smart contract functions through kpk’s Onchain Policies (Permissions Layer). This ensures that every action remains transparent, safe and verifiable, with both agents able to act within seconds when conditions change.

- Rebalancing agent: improves capital efficiency after any supply or borrowing event by allocating and rebalancing liquidity across approved markets using tier- and cap-aware rules, subject to safety and liquidity checks.

- Exit agent: safeguards funds by responding within seconds to risk alerts such as oracle staleness, price divergence, or liquidity stress, reducing or disabling exposure to affected markets, raising idle buffers, and prioritising safe exits within predefined limits.

Together, they enable continuous, rules-based management that ensures predictable performance and rapid response in all market conditions.

Automation in Action

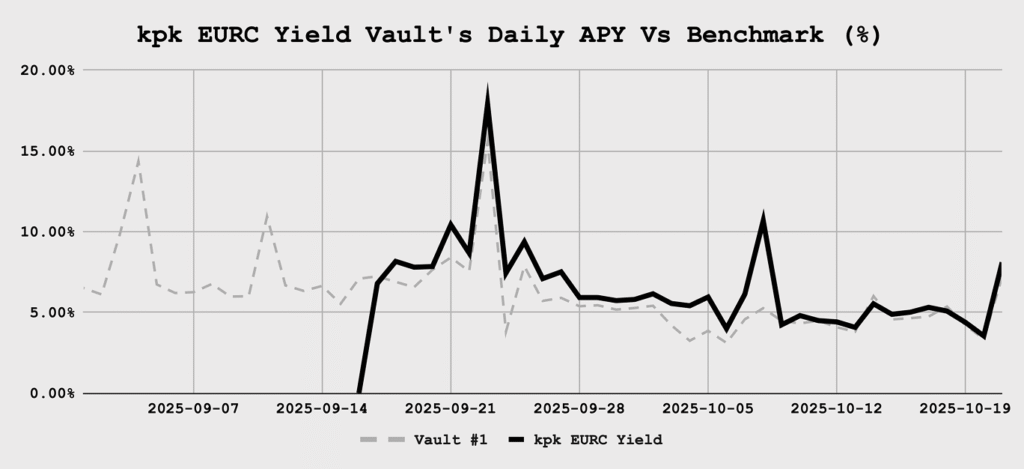

Real data demonstrates the impact of agent-based automation on vault performance.

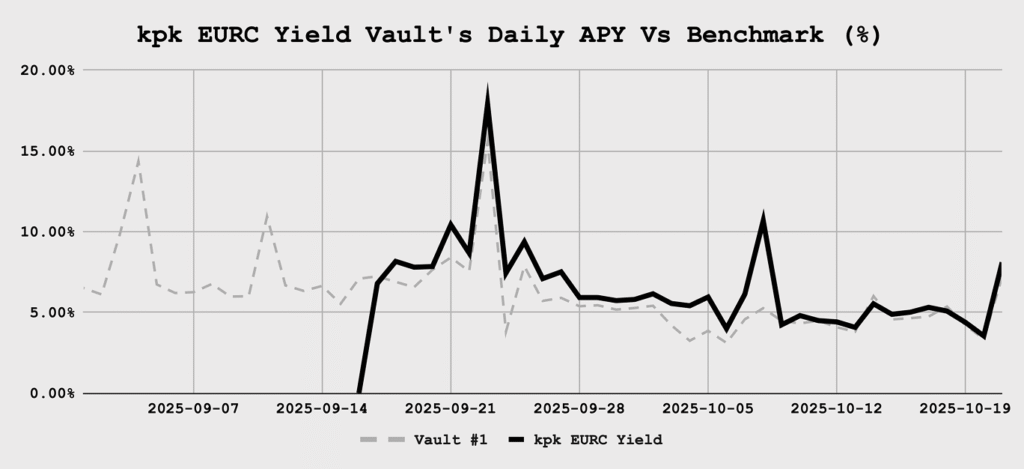

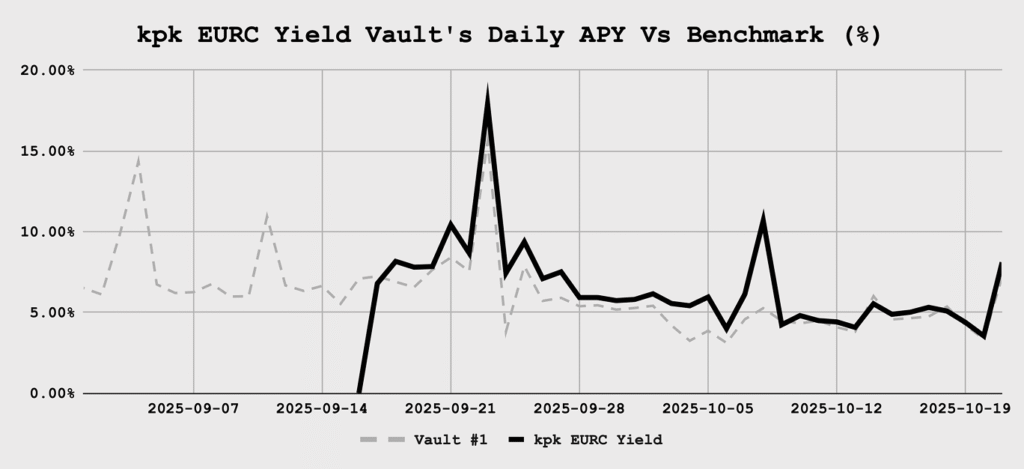

EURC Yield Vault

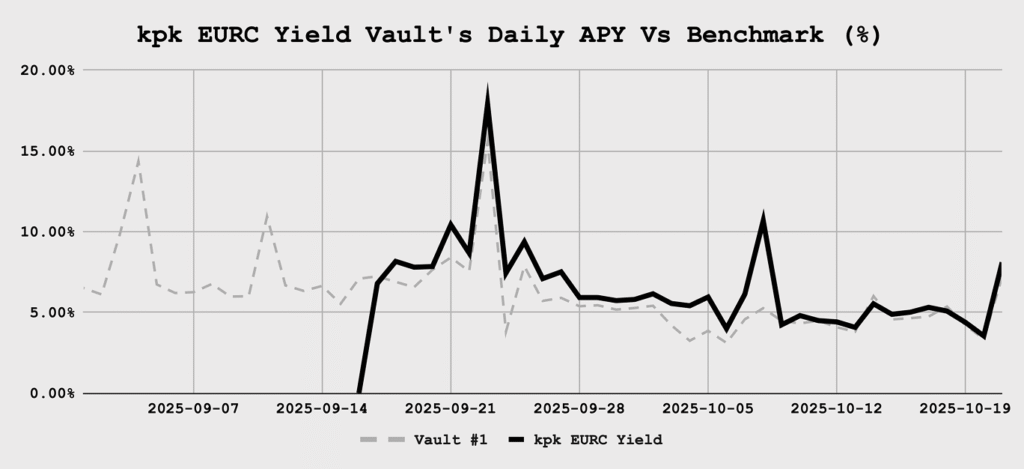

During Morpho’s soft-launch phase, kpk conducted a side-by-side comparison between its EURC Yield Vault and a benchmark vault with identical underlying markets and parameters, curated by another manager.

The distinction lay entirely in execution. While the benchmark relied on delayed or manual rebalancing, kpk’s vault operated continuously through automated agents that optimised allocation and reacted within seconds to utilisation and rate shifts.

Over the first weeks, kpk generated 35–46% higher realised yield from the same markets, providing clear evidence that speed and discipline directly translate into stronger performance.

Automation also improved liquidity resilience. When a liquidity crunch hit the EURC markets (>99% utilisation), the agents automatically moved funds into idle markets, freeing up around 19% of liquidity for withdrawals within seconds, while the benchmark vault remained over 97% illiquid for hours until manual intervention. Despite these stress conditions, kpk’s vault maintained a higher net yield by dynamically reallocating capital to the highest-yielding markets, preserving both performance and liquidity.

These results show that automation is not only about convenience but a measurable performance edge that compounds over time, maximising yield, maintaining liquidity, and reducing operational lag across market conditions.

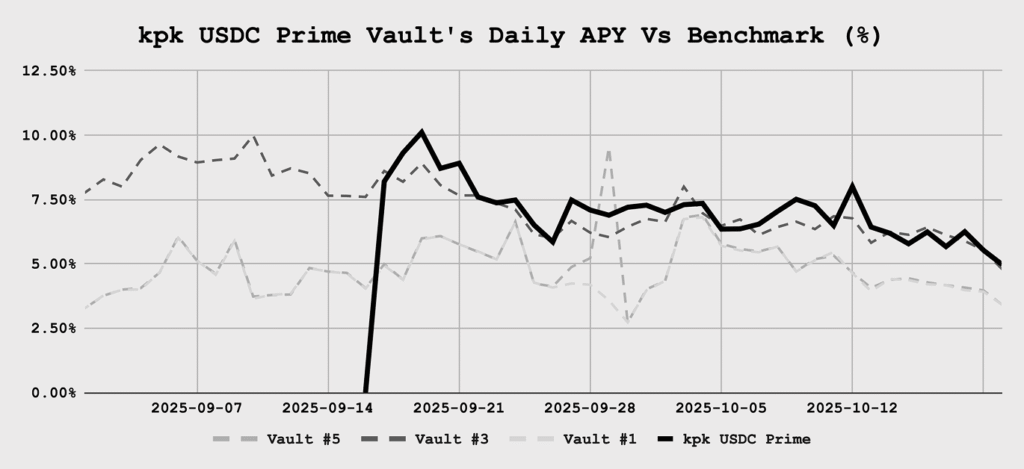

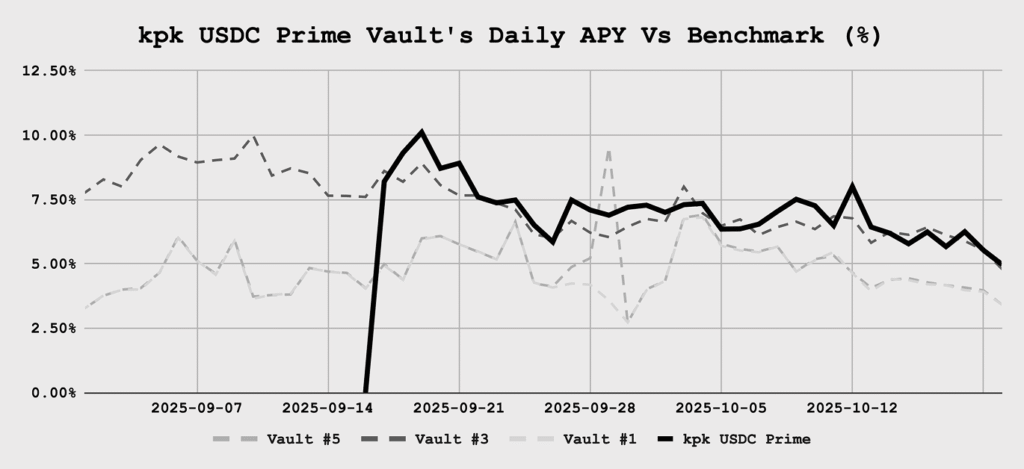

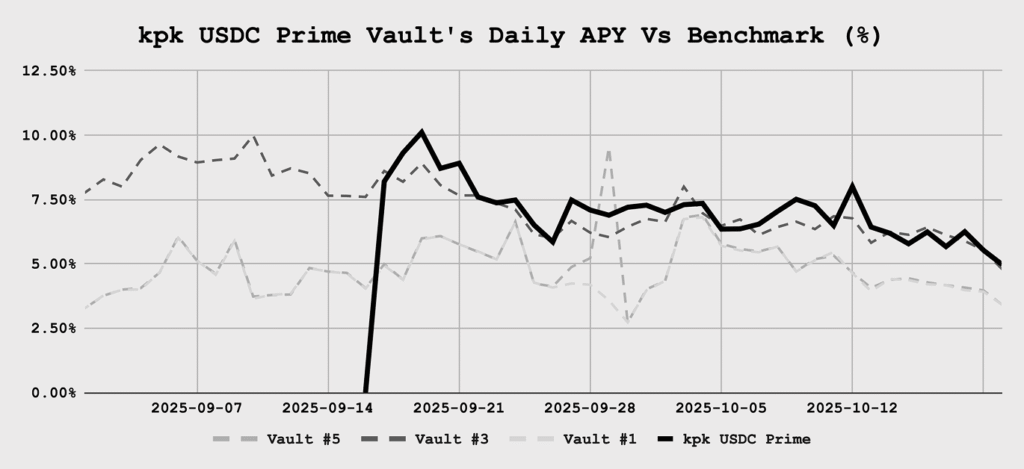

USDC Prime Vault

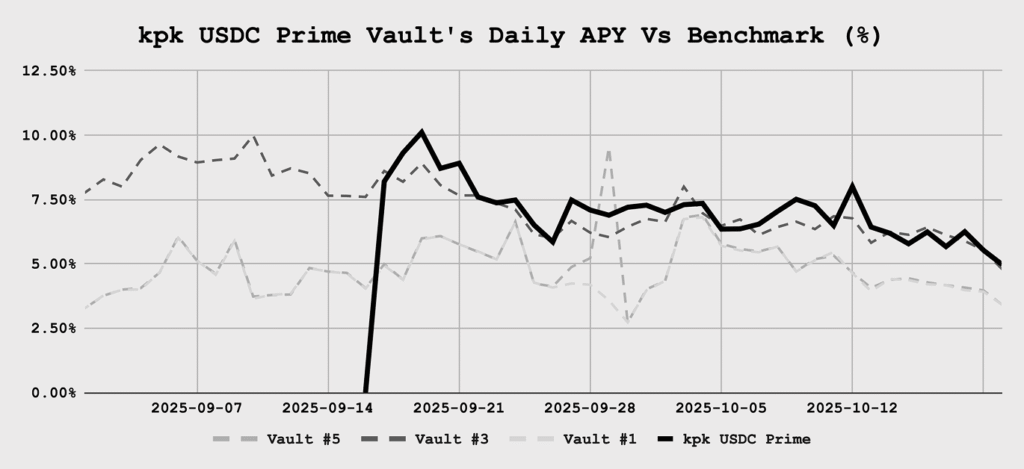

The USDC Prime Vault achieved similar consistency, maintaining optimal capital distribution and steady returns. The vault demonstrated higher yield curves and lower performance variance across the same period.

Together, these results validate the operational thesis: automation transforms policy into measurable performance, ensuring vaults remain responsive, transparent, and continuously optimised – even under stress.

KPK Rewards Programme

To open Vault Curation to the broader ecosystem, kpk is launching Season 1 Curation, a 90-day campaign designed to reward real users and accelerate adoption across curated and autonomous vaults.

Rewards are distributed using a TVL-weighted formula, ensuring that incentives scale with sustained participation and real capital contribution.

Up to 12.5M KPK tokens are allocated for Season 1, depending on total AUM reached by the end of the programme.

The programme will introduce an early-engagement multiplier and vault-specific boosts to further reward committed participants.

Eligible vaults include WETH and wstETH on Gearbox and USDC Prime and EURC Yield on Morpho. A simple structure, transparent metrics, and verifiable engagement — built to reward alignment, not speculation.

The programme is close to launch as Morpho vaults near public listing. The wait is almost over.

A System That Scales

Vault Curation began by bringing professional management standards to the broader ecosystem.

Agent-powered vaults extend that model into continuous, autonomous operation, while the KPK Rewards Programme opens participation to the ecosystem.

Together, they mark a decisive step in scaling onchain asset management, where automation reinforces discipline, transparency builds trust, and performance remains consistently strong.

ETH Earn Pool | wstETH Earn Pool | EURC Yield Vault

USDC Prime Vault | kpk Curation Handbook

Related Articles

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

Gnosis Pay Rewards: Under The Hood

The Permissions Layer safeguards against collusion with granular on-chain controls forming the stack’s foundation.

Towards the Age of Autonomous Vaults

Over the past five years, kpk has managed billions in assets for leading DAOs such as Gnosis and ENS, through a non-custodial infrastructure built for security, scalability, and verifiable execution.

The Onchain Policies (Permissions Layer) at the core of this stack enforce granular controls that eliminate single points of failure and ensure every action remains predictable and transparent.

That same infrastructure now powers kpk’s expansion into the curation market, applying the same discipline of rule-defined, policy-enforced management to agents operating within permissionless environments.

With Gearbox as the first step and Morpho next in line, Vault curation scales kpk’s asset management model by embracing predictable smart contract automation.

To accelerate adoption and reward sustained participation, kpk is also introducing the KPK Rewards Programme, designed to align ecosystem growth, engagement, and transparency through measurable contribution.

Agent-Powered Vaults

kpk vaults on Morpho represent the next stage of automation-centred design. Vault management is fully automated through two dedicated agents operated by kpk. The agents monitor borrow utilisation, APY shifts, price divergence versus reference venues, oracle liveness, and liquidity depth to ensure optimal performance.

These agents are not AI systems but logic-defined programmes that execute whitelisted smart contract functions through kpk’s Onchain Policies (Permissions Layer). This ensures that every action remains transparent, safe and verifiable, with both agents able to act within seconds when conditions change.

- Rebalancing agent: improves capital efficiency after any supply or borrowing event by allocating and rebalancing liquidity across approved markets using tier- and cap-aware rules, subject to safety and liquidity checks.

- Exit agent: safeguards funds by responding within seconds to risk alerts such as oracle staleness, price divergence, or liquidity stress, reducing or disabling exposure to affected markets, raising idle buffers, and prioritising safe exits within predefined limits.

Together, they enable continuous, rules-based management that ensures predictable performance and rapid response in all market conditions.

Automation in Action

Real data demonstrates the impact of agent-based automation on vault performance.

EURC Yield Vault

During Morpho’s soft-launch phase, kpk conducted a side-by-side comparison between its EURC Yield Vault and a benchmark vault with identical underlying markets and parameters, curated by another manager.

The distinction lay entirely in execution. While the benchmark relied on delayed or manual rebalancing, kpk’s vault operated continuously through automated agents that optimised allocation and reacted within seconds to utilisation and rate shifts.

Over the first weeks, kpk generated 35–46% higher realised yield from the same markets, providing clear evidence that speed and discipline directly translate into stronger performance.

Automation also improved liquidity resilience. When a liquidity crunch hit the EURC markets (>99% utilisation), the agents automatically moved funds into idle markets, freeing up around 19% of liquidity for withdrawals within seconds, while the benchmark vault remained over 97% illiquid for hours until manual intervention. Despite these stress conditions, kpk’s vault maintained a higher net yield by dynamically reallocating capital to the highest-yielding markets, preserving both performance and liquidity.

These results show that automation is not only about convenience but a measurable performance edge that compounds over time, maximising yield, maintaining liquidity, and reducing operational lag across market conditions.

USDC Prime Vault

The USDC Prime Vault achieved similar consistency, maintaining optimal capital distribution and steady returns. The vault demonstrated higher yield curves and lower performance variance across the same period.

Together, these results validate the operational thesis: automation transforms policy into measurable performance, ensuring vaults remain responsive, transparent, and continuously optimised – even under stress.

KPK Rewards Programme

To open Vault Curation to the broader ecosystem, kpk is launching Season 1 Curation, a 90-day campaign designed to reward real users and accelerate adoption across curated and autonomous vaults.

Rewards are distributed using a TVL-weighted formula, ensuring that incentives scale with sustained participation and real capital contribution.

Up to 12.5M KPK tokens are allocated for Season 1, depending on total AUM reached by the end of the programme.

The programme will introduce an early-engagement multiplier and vault-specific boosts to further reward committed participants.

Eligible vaults include WETH and wstETH on Gearbox and USDC Prime and EURC Yield on Morpho. A simple structure, transparent metrics, and verifiable engagement — built to reward alignment, not speculation.

The programme is close to launch as Morpho vaults near public listing. The wait is almost over.

A System That Scales

Vault Curation began by bringing professional management standards to the broader ecosystem.

Agent-powered vaults extend that model into continuous, autonomous operation, while the KPK Rewards Programme opens participation to the ecosystem.

Together, they mark a decisive step in scaling onchain asset management, where automation reinforces discipline, transparency builds trust, and performance remains consistently strong.

ETH Earn Pool | wstETH Earn Pool | EURC Yield Vault

USDC Prime Vault | kpk Curation Handbook

Related Articles

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Gnosis Pay Rewards: Under The Hood

The Permissions Layer safeguards against collusion with granular on-chain controls forming the stack’s foundation.

Towards the Age of Autonomous Vaults

Over the past five years, kpk has managed billions in assets for leading DAOs such as Gnosis and ENS, through a non-custodial infrastructure built for security, scalability, and verifiable execution.

The Onchain Policies (Permissions Layer) at the core of this stack enforce granular controls that eliminate single points of failure and ensure every action remains predictable and transparent.

That same infrastructure now powers kpk’s expansion into the curation market, applying the same discipline of rule-defined, policy-enforced management to agents operating within permissionless environments.

With Gearbox as the first step and Morpho next in line, Vault curation scales kpk’s asset management model by embracing predictable smart contract automation.

To accelerate adoption and reward sustained participation, kpk is also introducing the KPK Rewards Programme, designed to align ecosystem growth, engagement, and transparency through measurable contribution.

Agent-Powered Vaults

kpk vaults on Morpho represent the next stage of automation-centred design. Vault management is fully automated through two dedicated agents operated by kpk. The agents monitor borrow utilisation, APY shifts, price divergence versus reference venues, oracle liveness, and liquidity depth to ensure optimal performance.

These agents are not AI systems but logic-defined programmes that execute whitelisted smart contract functions through kpk’s Onchain Policies (Permissions Layer). This ensures that every action remains transparent, safe and verifiable, with both agents able to act within seconds when conditions change.

- Rebalancing agent: improves capital efficiency after any supply or borrowing event by allocating and rebalancing liquidity across approved markets using tier- and cap-aware rules, subject to safety and liquidity checks.

- Exit agent: safeguards funds by responding within seconds to risk alerts such as oracle staleness, price divergence, or liquidity stress, reducing or disabling exposure to affected markets, raising idle buffers, and prioritising safe exits within predefined limits.

Together, they enable continuous, rules-based management that ensures predictable performance and rapid response in all market conditions.

Automation in Action

Real data demonstrates the impact of agent-based automation on vault performance.

EURC Yield Vault

During Morpho’s soft-launch phase, kpk conducted a side-by-side comparison between its EURC Yield Vault and a benchmark vault with identical underlying markets and parameters, curated by another manager.

The distinction lay entirely in execution. While the benchmark relied on delayed or manual rebalancing, kpk’s vault operated continuously through automated agents that optimised allocation and reacted within seconds to utilisation and rate shifts.

Over the first weeks, kpk generated 35–46% higher realised yield from the same markets, providing clear evidence that speed and discipline directly translate into stronger performance.

Automation also improved liquidity resilience. When a liquidity crunch hit the EURC markets (>99% utilisation), the agents automatically moved funds into idle markets, freeing up around 19% of liquidity for withdrawals within seconds, while the benchmark vault remained over 97% illiquid for hours until manual intervention. Despite these stress conditions, kpk’s vault maintained a higher net yield by dynamically reallocating capital to the highest-yielding markets, preserving both performance and liquidity.

These results show that automation is not only about convenience but a measurable performance edge that compounds over time, maximising yield, maintaining liquidity, and reducing operational lag across market conditions.

USDC Prime Vault

The USDC Prime Vault achieved similar consistency, maintaining optimal capital distribution and steady returns. The vault demonstrated higher yield curves and lower performance variance across the same period.

Together, these results validate the operational thesis: automation transforms policy into measurable performance, ensuring vaults remain responsive, transparent, and continuously optimised – even under stress.

KPK Rewards Programme

To open Vault Curation to the broader ecosystem, kpk is launching Season 1 Curation, a 90-day campaign designed to reward real users and accelerate adoption across curated and autonomous vaults.

Rewards are distributed using a TVL-weighted formula, ensuring that incentives scale with sustained participation and real capital contribution.

Up to 12.5M KPK tokens are allocated for Season 1, depending on total AUM reached by the end of the programme.

The programme will introduce an early-engagement multiplier and vault-specific boosts to further reward committed participants.

Eligible vaults include WETH and wstETH on Gearbox and USDC Prime and EURC Yield on Morpho. A simple structure, transparent metrics, and verifiable engagement — built to reward alignment, not speculation.

The programme is close to launch as Morpho vaults near public listing. The wait is almost over.

A System That Scales

Vault Curation began by bringing professional management standards to the broader ecosystem.

Agent-powered vaults extend that model into continuous, autonomous operation, while the KPK Rewards Programme opens participation to the ecosystem.

Together, they mark a decisive step in scaling onchain asset management, where automation reinforces discipline, transparency builds trust, and performance remains consistently strong.

Related Articles

Towards the Age of Autonomous Vaults

Over the past five years, kpk has managed billions in assets for leading DAOs such as Gnosis and ENS, through a non-custodial infrastructure built for security, scalability, and verifiable execution.

The Onchain Policies (Permissions Layer) at the core of this stack enforce granular controls that eliminate single points of failure and ensure every action remains predictable and transparent.

That same infrastructure now powers kpk’s expansion into the curation market, applying the same discipline of rule-defined, policy-enforced management to agents operating within permissionless environments.

With Gearbox as the first step and Morpho next in line, Vault curation scales kpk’s asset management model by embracing predictable smart contract automation.

To accelerate adoption and reward sustained participation, kpk is also introducing the KPK Rewards Programme, designed to align ecosystem growth, engagement, and transparency through measurable contribution.

Agent-Powered Vaults

kpk vaults on Morpho represent the next stage of automation-centred design. Vault management is fully automated through two dedicated agents operated by kpk. The agents monitor borrow utilisation, APY shifts, price divergence versus reference venues, oracle liveness, and liquidity depth to ensure optimal performance.

These agents are not AI systems but logic-defined programmes that execute whitelisted smart contract functions through kpk’s Onchain Policies (Permissions Layer). This ensures that every action remains transparent, safe and verifiable, with both agents able to act within seconds when conditions change.

- Rebalancing agent: improves capital efficiency after any supply or borrowing event by allocating and rebalancing liquidity across approved markets using tier- and cap-aware rules, subject to safety and liquidity checks.

- Exit agent: safeguards funds by responding within seconds to risk alerts such as oracle staleness, price divergence, or liquidity stress, reducing or disabling exposure to affected markets, raising idle buffers, and prioritising safe exits within predefined limits.

Together, they enable continuous, rules-based management that ensures predictable performance and rapid response in all market conditions.

Automation in Action

Real data demonstrates the impact of agent-based automation on vault performance.

EURC Yield Vault

During Morpho’s soft-launch phase, kpk conducted a side-by-side comparison between its EURC Yield Vault and a benchmark vault with identical underlying markets and parameters, curated by another manager.

The distinction lay entirely in execution. While the benchmark relied on delayed or manual rebalancing, kpk’s vault operated continuously through automated agents that optimised allocation and reacted within seconds to utilisation and rate shifts.

Over the first weeks, kpk generated 35–46% higher realised yield from the same markets, providing clear evidence that speed and discipline directly translate into stronger performance.

Automation also improved liquidity resilience. When a liquidity crunch hit the EURC markets (>99% utilisation), the agents automatically moved funds into idle markets, freeing up around 19% of liquidity for withdrawals within seconds, while the benchmark vault remained over 97% illiquid for hours until manual intervention. Despite these stress conditions, kpk’s vault maintained a higher net yield by dynamically reallocating capital to the highest-yielding markets, preserving both performance and liquidity.

These results show that automation is not only about convenience but a measurable performance edge that compounds over time, maximising yield, maintaining liquidity, and reducing operational lag across market conditions.

USDC Prime Vault

The USDC Prime Vault achieved similar consistency, maintaining optimal capital distribution and steady returns. The vault demonstrated higher yield curves and lower performance variance across the same period.

Together, these results validate the operational thesis: automation transforms policy into measurable performance, ensuring vaults remain responsive, transparent, and continuously optimised – even under stress.

KPK Rewards Programme

To open Vault Curation to the broader ecosystem, kpk is launching Season 1 Curation, a 90-day campaign designed to reward real users and accelerate adoption across curated and autonomous vaults.

Rewards are distributed using a TVL-weighted formula, ensuring that incentives scale with sustained participation and real capital contribution.

Up to 12.5M KPK tokens are allocated for Season 1, depending on total AUM reached by the end of the programme.

The programme will introduce an early-engagement multiplier and vault-specific boosts to further reward committed participants.

Eligible vaults include WETH and wstETH on Gearbox and USDC Prime and EURC Yield on Morpho. A simple structure, transparent metrics, and verifiable engagement — built to reward alignment, not speculation.

The programme is close to launch as Morpho vaults near public listing. The wait is almost over.

A System That Scales

Vault Curation began by bringing professional management standards to the broader ecosystem.

Agent-powered vaults extend that model into continuous, autonomous operation, while the KPK Rewards Programme opens participation to the ecosystem.

Together, they mark a decisive step in scaling onchain asset management, where automation reinforces discipline, transparency builds trust, and performance remains consistently strong.