Deployed: Architecting An Investment Policy

Deployed is a series of high-level operational case studies that recall best practices in onchain asset management. Each article dives into the processes and expertise at the cutting edge of our industry, and how kpk is using them to drive forward best practices.

There are few things in life as frustrating as watching misalignment tear your organisation apart.

Time and again, we’ve seen titans of industry fall victim to poor investment decisions, a lack of accountability, or frustrating inaction caused by disagreement.

Those assets should have been used to help you grow! Instead, your multi-million dollar treasury languishes, opportunities pass you by, and you lament the early decisions which led to failure.

If there’s a single piece of advice that your organisation needs to hear before embarking on a process of onchain asset management, it’s to start by getting all your stakeholders—contributors, community members, investors and external service providers—on the same page.

The vital first step in effective onchain asset management is defining collective intent through an Investment Policy Statement (“IPS”).

This article explores how to align your stakeholders through the process of policy-setting. We dive into the key components of a strong IPS, and illustrate the value by exploring how the ENS DAO levelled up their endowment.

IPS

An investment policy statement is a singular living document that captures an organisation’s positions and policies on major questions of investment.

It’s intended to reflect the shared philosophy and attitude that guide the organisation’s treasury, and defines roles, obligations and boundaries to clarify and protect against overlap or overreach. A good IPS should be both sufficiently specific to enforce and sufficiently flexible to adapt.

We advocate for organisations to publicly approve their IPS. That could be through a resolution of its directors or trustees, a members’ proposal, or a ceremonial execution process. But in any event, some public recognition is always better than nothing in establishing legitimacy.

Why a policy?

Through our work supporting DeFi asset allocation across many decentralised organisations, we’ve observed a troubling pattern:

In a rush to mobilise the treasury, organisations jump excitedly to appoint treasury managers, deploy funds and count earnings. Over time, enthusiasm wains and small issues stack up. When a serious problem arises, no one takes ownership and most pass blame. Some confess to assuming the treasury manager’s sole responsibility, and switching off on the topic. Disputes arise about stakeholders’ responsibilities, and time is unnecessarily wasted exploring blame and omissions.

In these scenarios, it’s clear that a few core ingredients that were missed from the start. The likelihood and severity of disputes could be significantly reduced by establishing:

- The goals and objectives of the organisation and its different stakeholders;

- The responsibilities on each of the stakeholders;

- The limitations on the stakeholders’ differing powers;

- The standards for how the treasury and stakeholders should operate; and

- The expectations for evaluating the treasury and its managers’ performance.

An IPS is an upfront investment aimed at ensuring swift and effective accountability throughout complex treasury operations. It forces the relevant stakeholders to understand and share the expectations and limitations of their role. That investment of time and effort is expected to pay dividends when issues later arise.

As a rough average, we’ve found time taken to resolve disagreements over investments decision is more than halved where an IPS has been executed. The scale of this net reduction intuitively correlates with the investment horizon, meaning large treasuries with long timescales will compound these efficiencies through effective early planning.

There is also a noticeable correlation between investment policies and execution efficiency. Organisations with clear target allocations and risk parameters are far less likely to incur significant fees or short-term losses through sudden changes of course. And treasury managers with long-term, public mandates have more leverage to negotiate value-adds from partners, such as volume rebates or boosted emissions.

Architecting an IPS

In December 2024, we co-authored a comprehensive research report for the Uniswap DAO that explored best practices in mobilising onchain treasuries. Among other findings, we concluded that strong investment policies tend to orient around a few core elements:

- Outlining the principles and standards to govern the organisation’s investment activities;

- Defining the roles, powers, responsibilities and limitations of their stakeholders;

- Establishing the terms and expectations for treasury managers to be appointed, dismissed and measured through their tenure;

- Explaining the organisation’s investment goals and expectations;

- Agreeing the organisation’s range of acceptable investment activities;

- Understand the organisation’s needs for current and expected income and outgoings; and

- Specifying any adjustments for the organisation’s legal, compliance and tax needs.

When it comes to acceptable investment activities, an IPS will often outline and substantiate some of the acceptable options for inclusion in the treasury’s portfolio, including:

- Specific assets and asset types;

- Protocols, strategies and yield sources;

- Blockchains, trading venues and other investment environments;

- Activity types (e.g., liquidity provisioning, lending and derivatives); and

- Risk preferences or tolerances.

An IPS need not be a precise repository of every possible activity or preference, and will grow and change naturally over time. However, for activities that are closely aligned to the organisation’s values, the IPS aims to clarify and embody that position for all stakeholders.

Though many of the above details relate to forward-planning, IPSs also provide guidance for ongoing review and scrutiny of investment decisions. Functions like an oversight committee can be empowered by an IPS to follow clear routes to support and critique treasury managers’ work. A policy can also define persistent quantitative and qualitative assessment cycles, giving managers certainty over how performance is being measured.

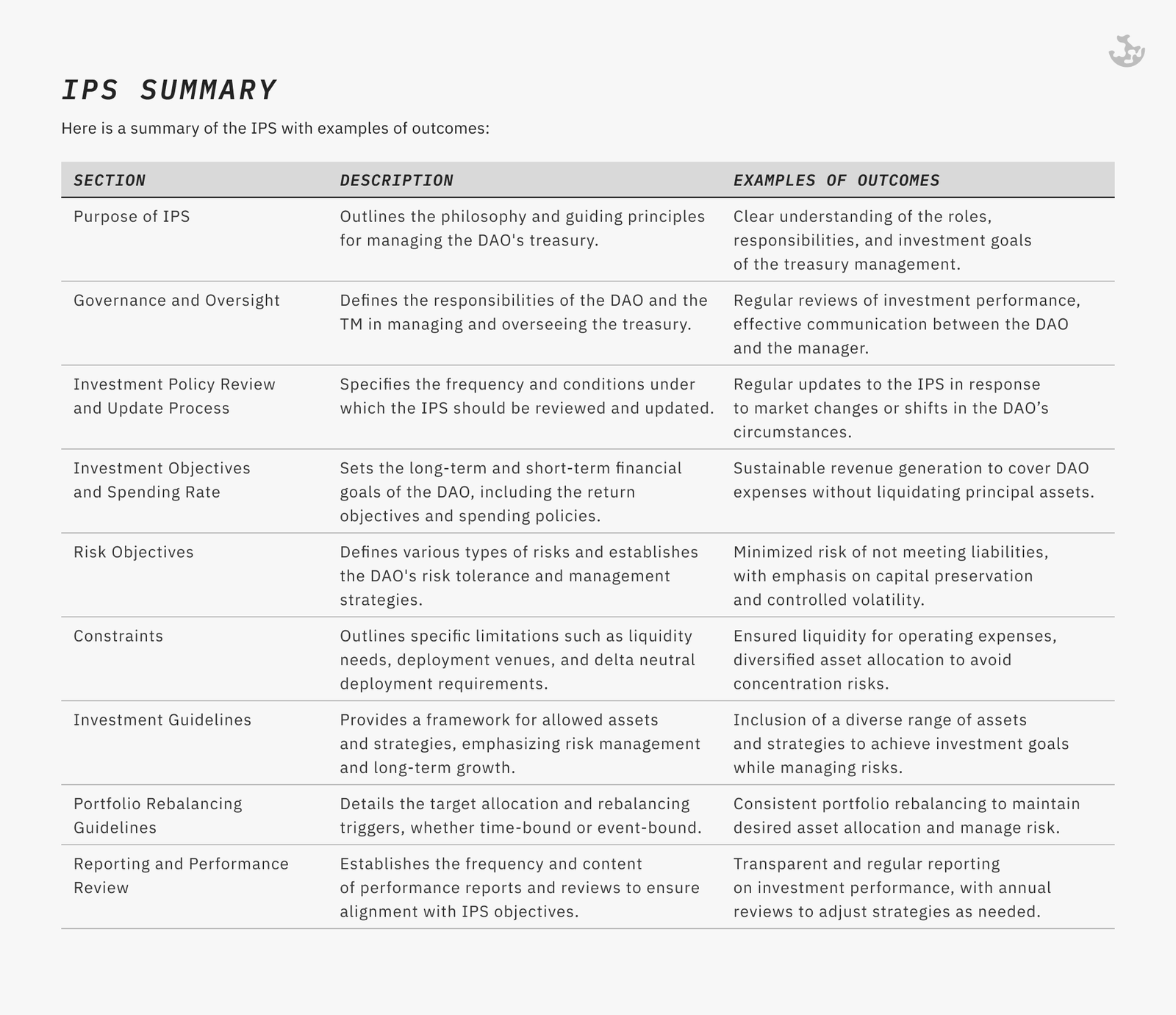

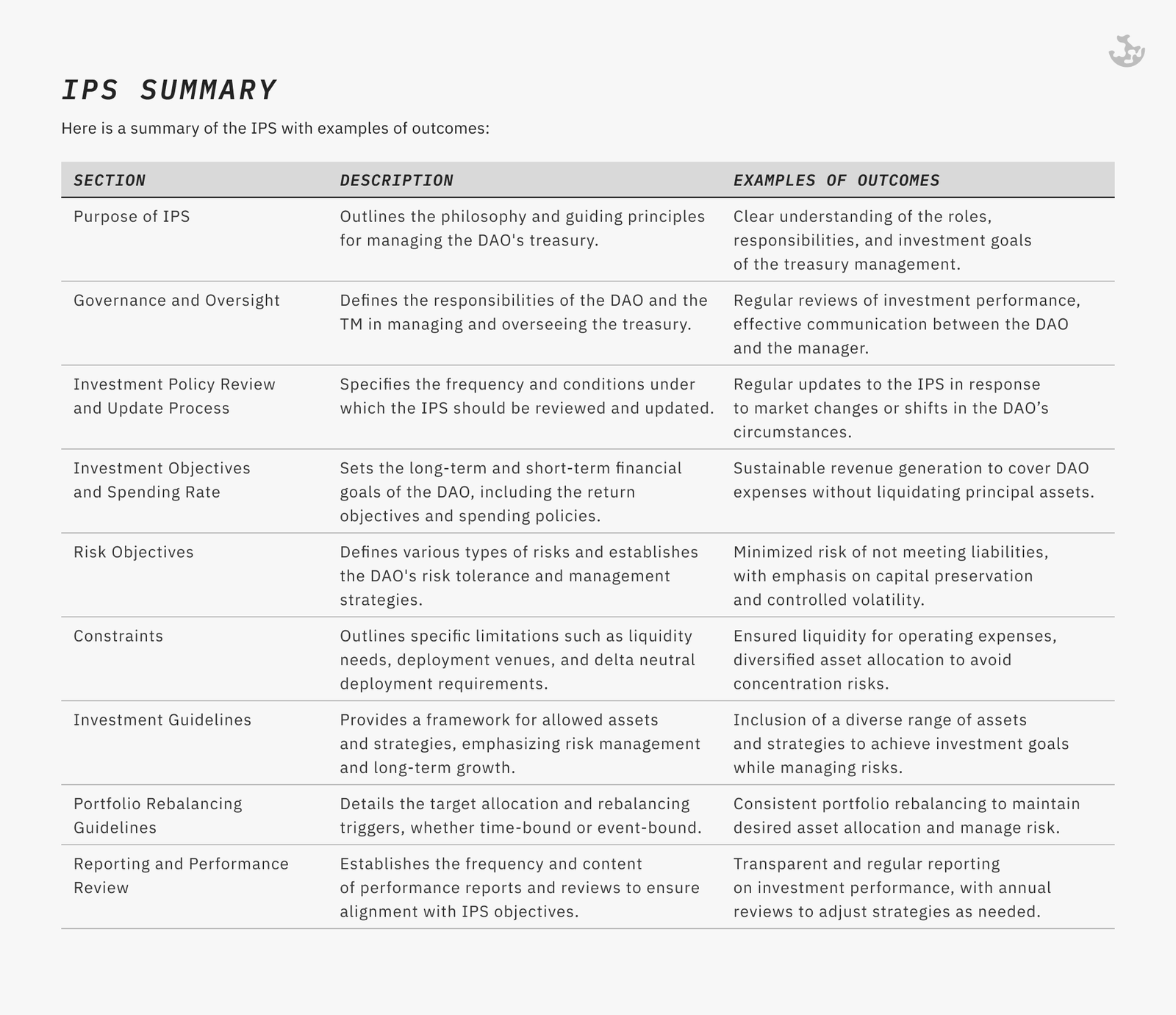

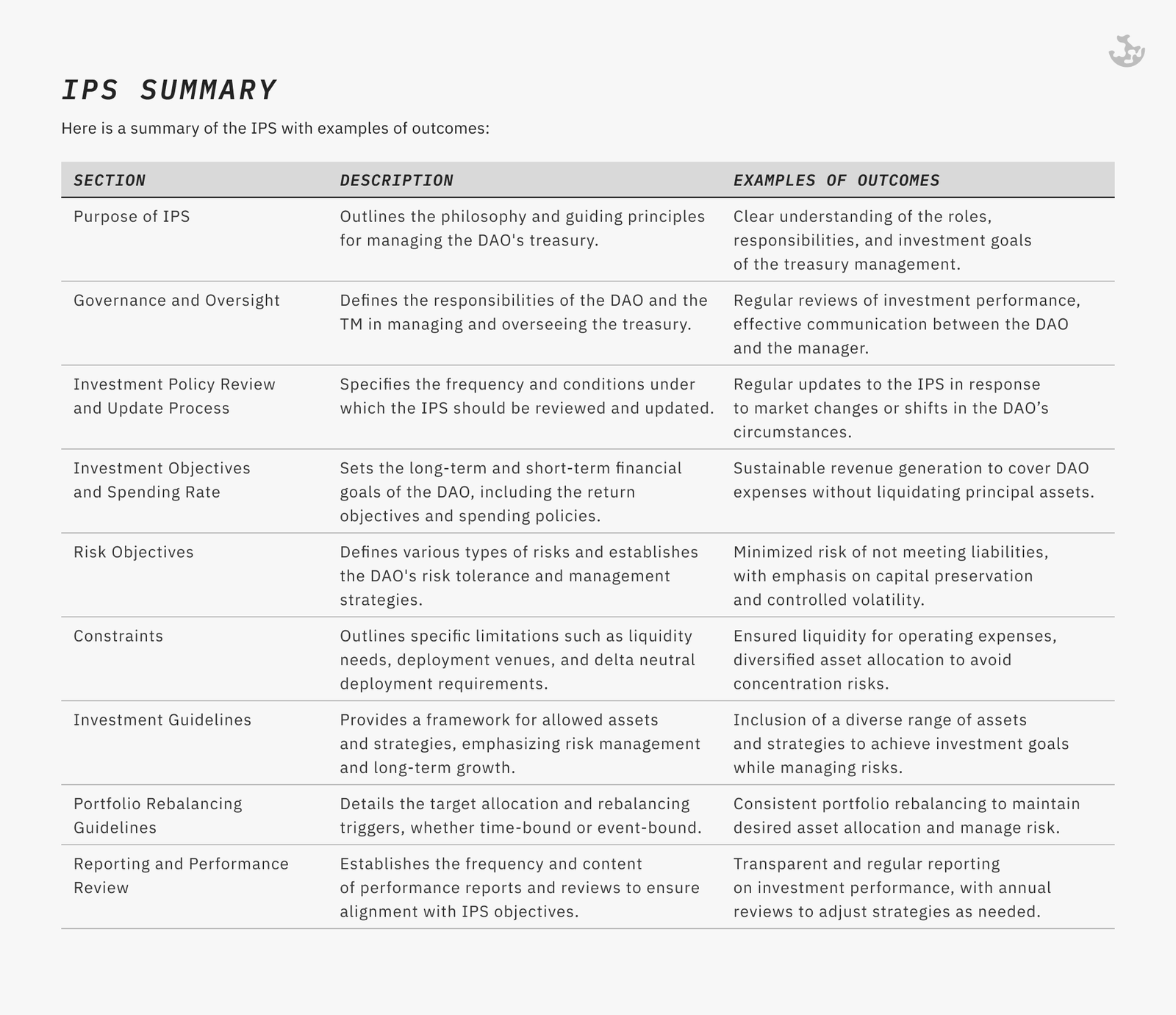

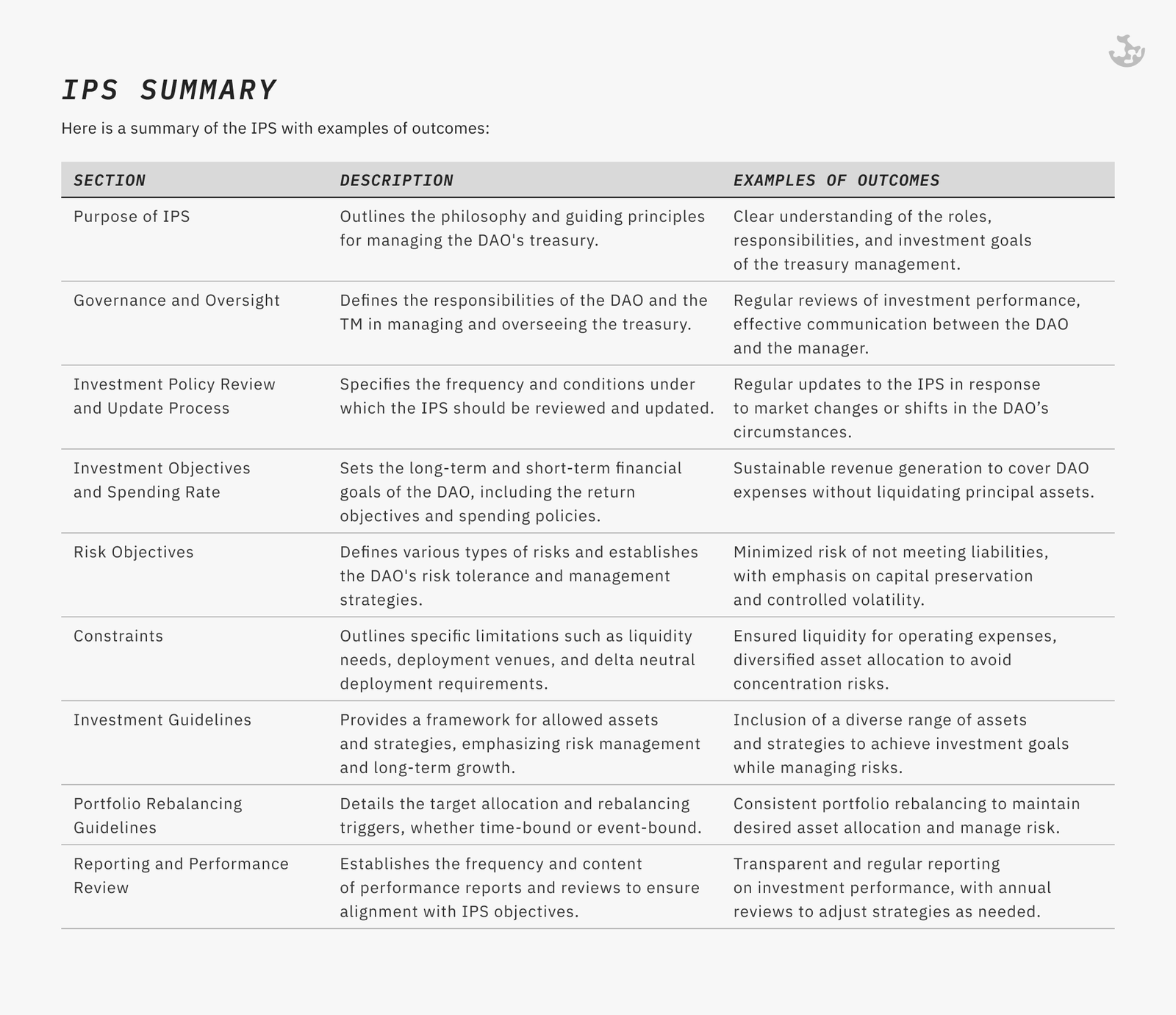

Uniswap Treasury Working Group Report (December 2025) – IPS Summary Table

Ultimately, the differing needs of each organisation warrants a bespoke approach to their IPS. Nonetheless, we encourage our partners to learn from others, by reviewing other policy statements and case studies:

ENS

A leading case study in IPS implementation is the Ethereum Name Service DAO (“ENS”).

In March 2023, ENS established an endowment for its treasury, following a competitive tender process. Though the Endowment operated effectively without a policy in its first year, the gradual increase in its DAO-allocated funds necessitated a holistic strategy that would scale with the DAO (rather than resetting the strategy with each new tranche of funding).

The ENS IPS establishes a few clear requirements and objectives that reflect the DAO’s unique needs and constraints:

- A 60/40 target ratio for exposure to Ether and stablecoins respectively. This balances the DAO’s principled alignment with the Ethereum ecosystem, together with its need to preserve runway and handle operating costs;

- “Unearned Revenue” exposure to Ether, meaning domain registration fees—which are taken upfront and not recorded as revenue until the end of the service period—should only be deployed in Ether-neutral strategies until they are fully earned to protect the DAO’s liability;

- A minimum stablecoin holding to reflect at least 3 years of DAO operating expenses at the current level, providing sufficient runway to survive lengthy market downturns; and

- Dedicated rebalancing triggers to review allocations on a bi-weekly basis and make alterations in 1,000 ETH tranches. This both maximises efficiency and provides a consistent, time-weighted approach to adjustments.

The deep connection to Ethereum has a central role in ENS’s treasury strategy. To maintain neutral exposure for unearned revenue, the DAO has assembled one of the largest liquid-staking token portfolios in the industry, deploying the majority of its ETH with external operators like RocketPool and Stader.

Before its IPS, the ENS Endowment was built gradually in response to immediate needs as they arose. By adopting a clear statement, the Endowment was able to begin projecting future activities and committing to specific allocations. This also allowed kpk as its treasury manager to enter into commercial relationships with partners—such as liquid-staking services—to access preferable terms and higher yields on the DAO’s assets.

The IPS experience has been a significant win-win for the DAO, and resulted in continual extensions of the Endowment’s allocated funds and an increasingly-sustainable financial future.

Deployed

A strong investment policy statement will often become the cornerstone for a sustainable DeFi treasury. Clear policies help to avoid confusion, mitigate disagreements and bring an organisation together. Treasuries which invest in establishing a policy early on help to prepare themselves for enduring execution and sustained success.

kpk’s team of treasury managers has assembled a wealth of experience in planning, securing and executing onchain asset management strategies. Among other foundational concepts, we feature the IPS as a core component of our asset management architecture.

Related Articles

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Gnosis Pay Rewards: Under The Hood

The Permissions Layer safeguards against collusion with granular on-chain controls forming the stack’s foundation.

Deployed: Architecting An Investment Policy

Deployed is a series of high-level operational case studies that recall best practices in onchain asset management. Each article dives into the processes and expertise at the cutting edge of our industry, and how kpk is using them to drive forward best practices.

There are few things in life as frustrating as watching misalignment tear your organisation apart.

Time and again, we’ve seen titans of industry fall victim to poor investment decisions, a lack of accountability, or frustrating inaction caused by disagreement.

Those assets should have been used to help you grow! Instead, your multi-million dollar treasury languishes, opportunities pass you by, and you lament the early decisions which led to failure.

If there’s a single piece of advice that your organisation needs to hear before embarking on a process of onchain asset management, it’s to start by getting all your stakeholders—contributors, community members, investors and external service providers—on the same page.

The vital first step in effective onchain asset management is defining collective intent through an Investment Policy Statement (“IPS”).

This article explores how to align your stakeholders through the process of policy-setting. We dive into the key components of a strong IPS, and illustrate the value by exploring how the ENS DAO levelled up their endowment.

IPS

An investment policy statement is a singular living document that captures an organisation’s positions and policies on major questions of investment.

It’s intended to reflect the shared philosophy and attitude that guide the organisation’s treasury, and defines roles, obligations and boundaries to clarify and protect against overlap or overreach. A good IPS should be both sufficiently specific to enforce and sufficiently flexible to adapt.

We advocate for organisations to publicly approve their IPS. That could be through a resolution of its directors or trustees, a members’ proposal, or a ceremonial execution process. But in any event, some public recognition is always better than nothing in establishing legitimacy.

Why a policy?

Through our work supporting DeFi asset allocation across many decentralised organisations, we’ve observed a troubling pattern:

In a rush to mobilise the treasury, organisations jump excitedly to appoint treasury managers, deploy funds and count earnings. Over time, enthusiasm wains and small issues stack up. When a serious problem arises, no one takes ownership and most pass blame. Some confess to assuming the treasury manager’s sole responsibility, and switching off on the topic. Disputes arise about stakeholders’ responsibilities, and time is unnecessarily wasted exploring blame and omissions.

In these scenarios, it’s clear that a few core ingredients that were missed from the start. The likelihood and severity of disputes could be significantly reduced by establishing:

- The goals and objectives of the organisation and its different stakeholders;

- The responsibilities on each of the stakeholders;

- The limitations on the stakeholders’ differing powers;

- The standards for how the treasury and stakeholders should operate; and

- The expectations for evaluating the treasury and its managers’ performance.

An IPS is an upfront investment aimed at ensuring swift and effective accountability throughout complex treasury operations. It forces the relevant stakeholders to understand and share the expectations and limitations of their role. That investment of time and effort is expected to pay dividends when issues later arise.

As a rough average, we’ve found time taken to resolve disagreements over investments decision is more than halved where an IPS has been executed. The scale of this net reduction intuitively correlates with the investment horizon, meaning large treasuries with long timescales will compound these efficiencies through effective early planning.

There is also a noticeable correlation between investment policies and execution efficiency. Organisations with clear target allocations and risk parameters are far less likely to incur significant fees or short-term losses through sudden changes of course. And treasury managers with long-term, public mandates have more leverage to negotiate value-adds from partners, such as volume rebates or boosted emissions.

Architecting an IPS

In December 2024, we co-authored a comprehensive research report for the Uniswap DAO that explored best practices in mobilising onchain treasuries. Among other findings, we concluded that strong investment policies tend to orient around a few core elements:

- Outlining the principles and standards to govern the organisation’s investment activities;

- Defining the roles, powers, responsibilities and limitations of their stakeholders;

- Establishing the terms and expectations for treasury managers to be appointed, dismissed and measured through their tenure;

- Explaining the organisation’s investment goals and expectations;

- Agreeing the organisation’s range of acceptable investment activities;

- Understand the organisation’s needs for current and expected income and outgoings; and

- Specifying any adjustments for the organisation’s legal, compliance and tax needs.

When it comes to acceptable investment activities, an IPS will often outline and substantiate some of the acceptable options for inclusion in the treasury’s portfolio, including:

- Specific assets and asset types;

- Protocols, strategies and yield sources;

- Blockchains, trading venues and other investment environments;

- Activity types (e.g., liquidity provisioning, lending and derivatives); and

- Risk preferences or tolerances.

An IPS need not be a precise repository of every possible activity or preference, and will grow and change naturally over time. However, for activities that are closely aligned to the organisation’s values, the IPS aims to clarify and embody that position for all stakeholders.

Though many of the above details relate to forward-planning, IPSs also provide guidance for ongoing review and scrutiny of investment decisions. Functions like an oversight committee can be empowered by an IPS to follow clear routes to support and critique treasury managers’ work. A policy can also define persistent quantitative and qualitative assessment cycles, giving managers certainty over how performance is being measured.

Uniswap Treasury Working Group Report (December 2025) – IPS Summary Table

Ultimately, the differing needs of each organisation warrants a bespoke approach to their IPS. Nonetheless, we encourage our partners to learn from others, by reviewing other policy statements and case studies:

ENS

A leading case study in IPS implementation is the Ethereum Name Service DAO (“ENS”).

In March 2023, ENS established an endowment for its treasury, following a competitive tender process. Though the Endowment operated effectively without a policy in its first year, the gradual increase in its DAO-allocated funds necessitated a holistic strategy that would scale with the DAO (rather than resetting the strategy with each new tranche of funding).

The ENS IPS establishes a few clear requirements and objectives that reflect the DAO’s unique needs and constraints:

- A 60/40 target ratio for exposure to Ether and stablecoins respectively. This balances the DAO’s principled alignment with the Ethereum ecosystem, together with its need to preserve runway and handle operating costs;

- “Unearned Revenue” exposure to Ether, meaning domain registration fees—which are taken upfront and not recorded as revenue until the end of the service period—should only be deployed in Ether-neutral strategies until they are fully earned to protect the DAO’s liability;

- A minimum stablecoin holding to reflect at least 3 years of DAO operating expenses at the current level, providing sufficient runway to survive lengthy market downturns; and

- Dedicated rebalancing triggers to review allocations on a bi-weekly basis and make alterations in 1,000 ETH tranches. This both maximises efficiency and provides a consistent, time-weighted approach to adjustments.

The deep connection to Ethereum has a central role in ENS’s treasury strategy. To maintain neutral exposure for unearned revenue, the DAO has assembled one of the largest liquid-staking token portfolios in the industry, deploying the majority of its ETH with external operators like RocketPool and Stader.

Before its IPS, the ENS Endowment was built gradually in response to immediate needs as they arose. By adopting a clear statement, the Endowment was able to begin projecting future activities and committing to specific allocations. This also allowed kpk as its treasury manager to enter into commercial relationships with partners—such as liquid-staking services—to access preferable terms and higher yields on the DAO’s assets.

The IPS experience has been a significant win-win for the DAO, and resulted in continual extensions of the Endowment’s allocated funds and an increasingly-sustainable financial future.

Deployed

A strong investment policy statement will often become the cornerstone for a sustainable DeFi treasury. Clear policies help to avoid confusion, mitigate disagreements and bring an organisation together. Treasuries which invest in establishing a policy early on help to prepare themselves for enduring execution and sustained success.

kpk’s team of treasury managers has assembled a wealth of experience in planning, securing and executing onchain asset management strategies. Among other foundational concepts, we feature the IPS as a core component of our asset management architecture.

Related Articles

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Gnosis Pay Rewards: Under The Hood

The Permissions Layer safeguards against collusion with granular on-chain controls forming the stack’s foundation.

Deployed: Architecting An Investment Policy

Deployed is a series of high-level operational case studies that recall best practices in onchain asset management. Each article dives into the processes and expertise at the cutting edge of our industry, and how kpk is using them to drive forward best practices.

There are few things in life as frustrating as watching misalignment tear your organisation apart.

Time and again, we’ve seen titans of industry fall victim to poor investment decisions, a lack of accountability, or frustrating inaction caused by disagreement.

Those assets should have been used to help you grow! Instead, your multi-million dollar treasury languishes, opportunities pass you by, and you lament the early decisions which led to failure.

If there’s a single piece of advice that your organisation needs to hear before embarking on a process of onchain asset management, it’s to start by getting all your stakeholders—contributors, community members, investors and external service providers—on the same page.

The vital first step in effective onchain asset management is defining collective intent through an Investment Policy Statement (“IPS”).

This article explores how to align your stakeholders through the process of policy-setting. We dive into the key components of a strong IPS, and illustrate the value by exploring how the ENS DAO levelled up their endowment.

IPS

An investment policy statement is a singular living document that captures an organisation’s positions and policies on major questions of investment.

It’s intended to reflect the shared philosophy and attitude that guide the organisation’s treasury, and defines roles, obligations and boundaries to clarify and protect against overlap or overreach. A good IPS should be both sufficiently specific to enforce and sufficiently flexible to adapt.

We advocate for organisations to publicly approve their IPS. That could be through a resolution of its directors or trustees, a members’ proposal, or a ceremonial execution process. But in any event, some public recognition is always better than nothing in establishing legitimacy.

Why a policy?

Through our work supporting DeFi asset allocation across many decentralised organisations, we’ve observed a troubling pattern:

In a rush to mobilise the treasury, organisations jump excitedly to appoint treasury managers, deploy funds and count earnings. Over time, enthusiasm wains and small issues stack up. When a serious problem arises, no one takes ownership and most pass blame. Some confess to assuming the treasury manager’s sole responsibility, and switching off on the topic. Disputes arise about stakeholders’ responsibilities, and time is unnecessarily wasted exploring blame and omissions.

In these scenarios, it’s clear that a few core ingredients that were missed from the start. The likelihood and severity of disputes could be significantly reduced by establishing:

- The goals and objectives of the organisation and its different stakeholders;

- The responsibilities on each of the stakeholders;

- The limitations on the stakeholders’ differing powers;

- The standards for how the treasury and stakeholders should operate; and

- The expectations for evaluating the treasury and its managers’ performance.

An IPS is an upfront investment aimed at ensuring swift and effective accountability throughout complex treasury operations. It forces the relevant stakeholders to understand and share the expectations and limitations of their role. That investment of time and effort is expected to pay dividends when issues later arise.

As a rough average, we’ve found time taken to resolve disagreements over investments decision is more than halved where an IPS has been executed. The scale of this net reduction intuitively correlates with the investment horizon, meaning large treasuries with long timescales will compound these efficiencies through effective early planning.

There is also a noticeable correlation between investment policies and execution efficiency. Organisations with clear target allocations and risk parameters are far less likely to incur significant fees or short-term losses through sudden changes of course. And treasury managers with long-term, public mandates have more leverage to negotiate value-adds from partners, such as volume rebates or boosted emissions.

Architecting an IPS

In December 2024, we co-authored a comprehensive research report for the Uniswap DAO that explored best practices in mobilising onchain treasuries. Among other findings, we concluded that strong investment policies tend to orient around a few core elements:

- Outlining the principles and standards to govern the organisation’s investment activities;

- Defining the roles, powers, responsibilities and limitations of their stakeholders;

- Establishing the terms and expectations for treasury managers to be appointed, dismissed and measured through their tenure;

- Explaining the organisation’s investment goals and expectations;

- Agreeing the organisation’s range of acceptable investment activities;

- Understand the organisation’s needs for current and expected income and outgoings; and

- Specifying any adjustments for the organisation’s legal, compliance and tax needs.

When it comes to acceptable investment activities, an IPS will often outline and substantiate some of the acceptable options for inclusion in the treasury’s portfolio, including:

- Specific assets and asset types;

- Protocols, strategies and yield sources;

- Blockchains, trading venues and other investment environments;

- Activity types (e.g., liquidity provisioning, lending and derivatives); and

- Risk preferences or tolerances.

An IPS need not be a precise repository of every possible activity or preference, and will grow and change naturally over time. However, for activities that are closely aligned to the organisation’s values, the IPS aims to clarify and embody that position for all stakeholders.

Though many of the above details relate to forward-planning, IPSs also provide guidance for ongoing review and scrutiny of investment decisions. Functions like an oversight committee can be empowered by an IPS to follow clear routes to support and critique treasury managers’ work. A policy can also define persistent quantitative and qualitative assessment cycles, giving managers certainty over how performance is being measured.

Uniswap Treasury Working Group Report (December 2025) – IPS Summary Table

Ultimately, the differing needs of each organisation warrants a bespoke approach to their IPS. Nonetheless, we encourage our partners to learn from others, by reviewing other policy statements and case studies:

ENS

A leading case study in IPS implementation is the Ethereum Name Service DAO (“ENS”).

In March 2023, ENS established an endowment for its treasury, following a competitive tender process. Though the Endowment operated effectively without a policy in its first year, the gradual increase in its DAO-allocated funds necessitated a holistic strategy that would scale with the DAO (rather than resetting the strategy with each new tranche of funding).

The ENS IPS establishes a few clear requirements and objectives that reflect the DAO’s unique needs and constraints:

- A 60/40 target ratio for exposure to Ether and stablecoins respectively. This balances the DAO’s principled alignment with the Ethereum ecosystem, together with its need to preserve runway and handle operating costs;

- “Unearned Revenue” exposure to Ether, meaning domain registration fees—which are taken upfront and not recorded as revenue until the end of the service period—should only be deployed in Ether-neutral strategies until they are fully earned to protect the DAO’s liability;

- A minimum stablecoin holding to reflect at least 3 years of DAO operating expenses at the current level, providing sufficient runway to survive lengthy market downturns; and

- Dedicated rebalancing triggers to review allocations on a bi-weekly basis and make alterations in 1,000 ETH tranches. This both maximises efficiency and provides a consistent, time-weighted approach to adjustments.

The deep connection to Ethereum has a central role in ENS’s treasury strategy. To maintain neutral exposure for unearned revenue, the DAO has assembled one of the largest liquid-staking token portfolios in the industry, deploying the majority of its ETH with external operators like RocketPool and Stader.

Before its IPS, the ENS Endowment was built gradually in response to immediate needs as they arose. By adopting a clear statement, the Endowment was able to begin projecting future activities and committing to specific allocations. This also allowed kpk as its treasury manager to enter into commercial relationships with partners—such as liquid-staking services—to access preferable terms and higher yields on the DAO’s assets.

The IPS experience has been a significant win-win for the DAO, and resulted in continual extensions of the Endowment’s allocated funds and an increasingly-sustainable financial future.

Deployed

A strong investment policy statement will often become the cornerstone for a sustainable DeFi treasury. Clear policies help to avoid confusion, mitigate disagreements and bring an organisation together. Treasuries which invest in establishing a policy early on help to prepare themselves for enduring execution and sustained success.

kpk’s team of treasury managers has assembled a wealth of experience in planning, securing and executing onchain asset management strategies. Among other foundational concepts, we feature the IPS as a core component of our asset management architecture.

Related Articles

Deployed: Architecting An Investment Policy

Deployed is a series of high-level operational case studies that recall best practices in onchain asset management. Each article dives into the processes and expertise at the cutting edge of our industry, and how kpk is using them to drive forward best practices.

There are few things in life as frustrating as watching misalignment tear your organisation apart.

Time and again, we’ve seen titans of industry fall victim to poor investment decisions, a lack of accountability, or frustrating inaction caused by disagreement.

Those assets should have been used to help you grow! Instead, your multi-million dollar treasury languishes, opportunities pass you by, and you lament the early decisions which led to failure.

If there’s a single piece of advice that your organisation needs to hear before embarking on a process of onchain asset management, it’s to start by getting all your stakeholders—contributors, community members, investors and external service providers—on the same page.

The vital first step in effective onchain asset management is defining collective intent through an Investment Policy Statement (“IPS”).

This article explores how to align your stakeholders through the process of policy-setting. We dive into the key components of a strong IPS, and illustrate the value by exploring how the ENS DAO levelled up their endowment.

IPS

An investment policy statement is a singular living document that captures an organisation’s positions and policies on major questions of investment.

It’s intended to reflect the shared philosophy and attitude that guide the organisation’s treasury, and defines roles, obligations and boundaries to clarify and protect against overlap or overreach. A good IPS should be both sufficiently specific to enforce and sufficiently flexible to adapt.

We advocate for organisations to publicly approve their IPS. That could be through a resolution of its directors or trustees, a members’ proposal, or a ceremonial execution process. But in any event, some public recognition is always better than nothing in establishing legitimacy.

Why a policy?

Through our work supporting DeFi asset allocation across many decentralised organisations, we’ve observed a troubling pattern:

In a rush to mobilise the treasury, organisations jump excitedly to appoint treasury managers, deploy funds and count earnings. Over time, enthusiasm wains and small issues stack up. When a serious problem arises, no one takes ownership and most pass blame. Some confess to assuming the treasury manager’s sole responsibility, and switching off on the topic. Disputes arise about stakeholders’ responsibilities, and time is unnecessarily wasted exploring blame and omissions.

In these scenarios, it’s clear that a few core ingredients that were missed from the start. The likelihood and severity of disputes could be significantly reduced by establishing:

- The goals and objectives of the organisation and its different stakeholders;

- The responsibilities on each of the stakeholders;

- The limitations on the stakeholders’ differing powers;

- The standards for how the treasury and stakeholders should operate; and

- The expectations for evaluating the treasury and its managers’ performance.

An IPS is an upfront investment aimed at ensuring swift and effective accountability throughout complex treasury operations. It forces the relevant stakeholders to understand and share the expectations and limitations of their role. That investment of time and effort is expected to pay dividends when issues later arise.

As a rough average, we’ve found time taken to resolve disagreements over investments decision is more than halved where an IPS has been executed. The scale of this net reduction intuitively correlates with the investment horizon, meaning large treasuries with long timescales will compound these efficiencies through effective early planning.

There is also a noticeable correlation between investment policies and execution efficiency. Organisations with clear target allocations and risk parameters are far less likely to incur significant fees or short-term losses through sudden changes of course. And treasury managers with long-term, public mandates have more leverage to negotiate value-adds from partners, such as volume rebates or boosted emissions.

Architecting an IPS

In December 2024, we co-authored a comprehensive research report for the Uniswap DAO that explored best practices in mobilising onchain treasuries. Among other findings, we concluded that strong investment policies tend to orient around a few core elements:

- Outlining the principles and standards to govern the organisation’s investment activities;

- Defining the roles, powers, responsibilities and limitations of their stakeholders;

- Establishing the terms and expectations for treasury managers to be appointed, dismissed and measured through their tenure;

- Explaining the organisation’s investment goals and expectations;

- Agreeing the organisation’s range of acceptable investment activities;

- Understand the organisation’s needs for current and expected income and outgoings; and

- Specifying any adjustments for the organisation’s legal, compliance and tax needs.

When it comes to acceptable investment activities, an IPS will often outline and substantiate some of the acceptable options for inclusion in the treasury’s portfolio, including:

- Specific assets and asset types;

- Protocols, strategies and yield sources;

- Blockchains, trading venues and other investment environments;

- Activity types (e.g., liquidity provisioning, lending and derivatives); and

- Risk preferences or tolerances.

An IPS need not be a precise repository of every possible activity or preference, and will grow and change naturally over time. However, for activities that are closely aligned to the organisation’s values, the IPS aims to clarify and embody that position for all stakeholders.

Though many of the above details relate to forward-planning, IPSs also provide guidance for ongoing review and scrutiny of investment decisions. Functions like an oversight committee can be empowered by an IPS to follow clear routes to support and critique treasury managers’ work. A policy can also define persistent quantitative and qualitative assessment cycles, giving managers certainty over how performance is being measured.

Uniswap Treasury Working Group Report (December 2025) – IPS Summary Table

Ultimately, the differing needs of each organisation warrants a bespoke approach to their IPS. Nonetheless, we encourage our partners to learn from others, by reviewing other policy statements and case studies:

ENS

A leading case study in IPS implementation is the Ethereum Name Service DAO (“ENS”).

In March 2023, ENS established an endowment for its treasury, following a competitive tender process. Though the Endowment operated effectively without a policy in its first year, the gradual increase in its DAO-allocated funds necessitated a holistic strategy that would scale with the DAO (rather than resetting the strategy with each new tranche of funding).

The ENS IPS establishes a few clear requirements and objectives that reflect the DAO’s unique needs and constraints:

- A 60/40 target ratio for exposure to Ether and stablecoins respectively. This balances the DAO’s principled alignment with the Ethereum ecosystem, together with its need to preserve runway and handle operating costs;

- “Unearned Revenue” exposure to Ether, meaning domain registration fees—which are taken upfront and not recorded as revenue until the end of the service period—should only be deployed in Ether-neutral strategies until they are fully earned to protect the DAO’s liability;

- A minimum stablecoin holding to reflect at least 3 years of DAO operating expenses at the current level, providing sufficient runway to survive lengthy market downturns; and

- Dedicated rebalancing triggers to review allocations on a bi-weekly basis and make alterations in 1,000 ETH tranches. This both maximises efficiency and provides a consistent, time-weighted approach to adjustments.

The deep connection to Ethereum has a central role in ENS’s treasury strategy. To maintain neutral exposure for unearned revenue, the DAO has assembled one of the largest liquid-staking token portfolios in the industry, deploying the majority of its ETH with external operators like RocketPool and Stader.

Before its IPS, the ENS Endowment was built gradually in response to immediate needs as they arose. By adopting a clear statement, the Endowment was able to begin projecting future activities and committing to specific allocations. This also allowed kpk as its treasury manager to enter into commercial relationships with partners—such as liquid-staking services—to access preferable terms and higher yields on the DAO’s assets.

The IPS experience has been a significant win-win for the DAO, and resulted in continual extensions of the Endowment’s allocated funds and an increasingly-sustainable financial future.

Deployed

A strong investment policy statement will often become the cornerstone for a sustainable DeFi treasury. Clear policies help to avoid confusion, mitigate disagreements and bring an organisation together. Treasuries which invest in establishing a policy early on help to prepare themselves for enduring execution and sustained success.

kpk’s team of treasury managers has assembled a wealth of experience in planning, securing and executing onchain asset management strategies. Among other foundational concepts, we feature the IPS as a core component of our asset management architecture.