Case Study: The Ethereum Foundation’s Treasury Policy

In May 2025, kpk was asked by the Ethereum Foundation to serve as an advisor in the preparation of its long-term investment strategy. This collaboration resulted in the creation and publication of a new Treasury Policy, a key milestone in aligning capital deployment with Ethereum’s values.

Most DAOs and mission-driven treasuries don’t fail because of a lack of funds. They fail from lack of structure. Before chasing returns, what matters is transparency, clarity and alignment. That’s why we begin each onchain asset management process by defining a clear investment policy.

The EF, however, is not just any organisation. Not only is it a strict non-profit with clear operational constraints, it’s a flag-bearer for the virtues of Ethereum.

This case study explores the challenges for foundations and non-profits like the EF in implementing strong investment policies, and some of the best practices and guidance that kpk employed to support this new chapter for Ethereum.

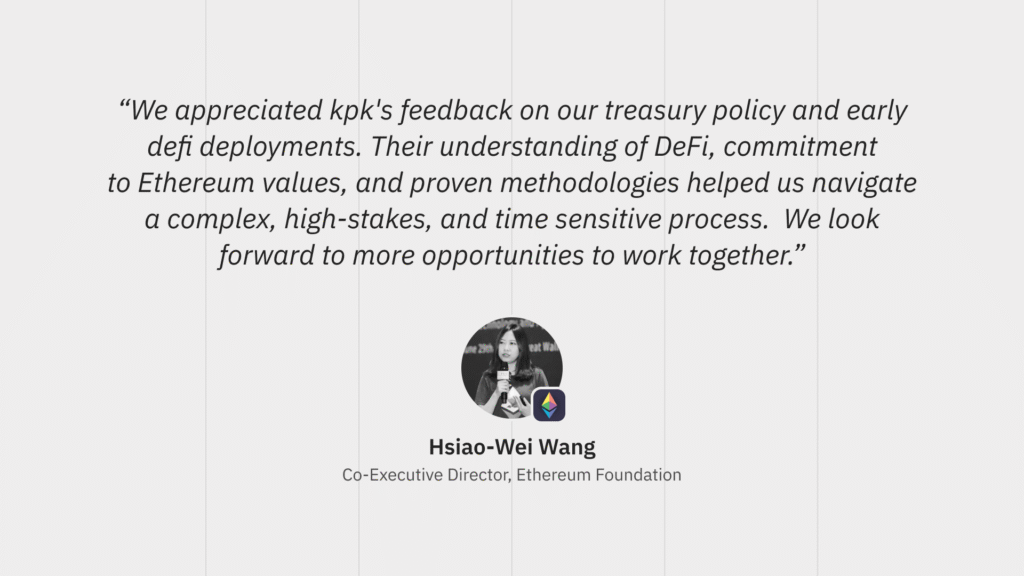

Quote from Hsiao-Wei Wang, Co-Executive Director, Ethereum Foundation

Deploying in DeFi: From Values to Action

The Ethereum Foundation has always played an essential role in supporting research and development for Ethereum’s infrastructure, which in turn is vital for DeFi. In recent months, the connection between the EF and DeFi has changed.

In February, the EF deployed 45,000 Ether from its treasury into several DeFi protocols; signaling to the world its intention to embrace DeFi.

This shift towards DeFi comes at a timely moment for Ethereum’s long-term vision. The EF has recently reset its priorities to focus on improving Ethereum’s user experience and scaling its Layer 1 and blobs. The move into DeFi is another significant milestone in this new era.

However, the EF’s move to embrace DeFi must be balanced against its position as a representative of Ethereum’s values, and one of the most visible onchain treasuries. At the centre of these efforts is the question of how to determine whether investment decisions align with the Ethereum Foundation’s values, as its utmost priority.

And, for ecosystem participants keen to support this move, the question remains: how will the EF clearly and fairly deploy capital into DeFi while ensuring value alignment?

Clear Methodology

Against this context, the EF was faced with a difficult challenge: implementing a policy for investment decisions that resonates not only with their board, finance team and contributors, but with the broader Ethereum community and global financial system at large.

Without clarity over approach, leading organisations like the EF may face criticism over transparency, regulatory risk from overstepping obligations, and even capital loss in the event of poorly-executed investments. Getting all of the necessary stakeholders on the same page is vital for properly mobilising any large non-profit treasury.

Beyond enabling better decisions, a well-crafted investment policy statement can insulate foundations from reputational or legal risks. It provides a clear record of how capital deployment decisions are made, and ensures they remain aligned with the organisation’s mission and scope. As regulatory interest in onchain investment grows, this level of transparency and discipline is becoming increasingly essential.

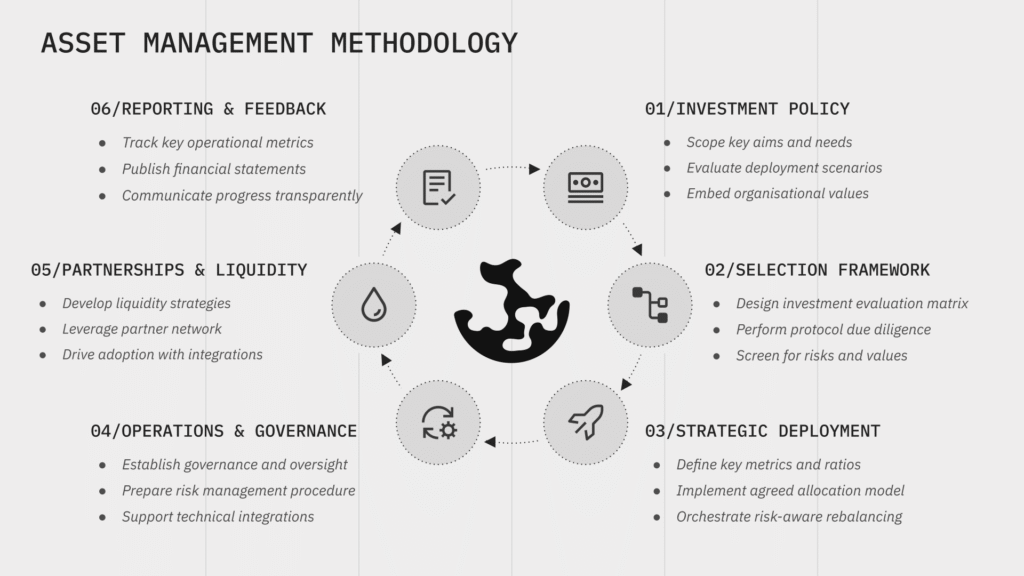

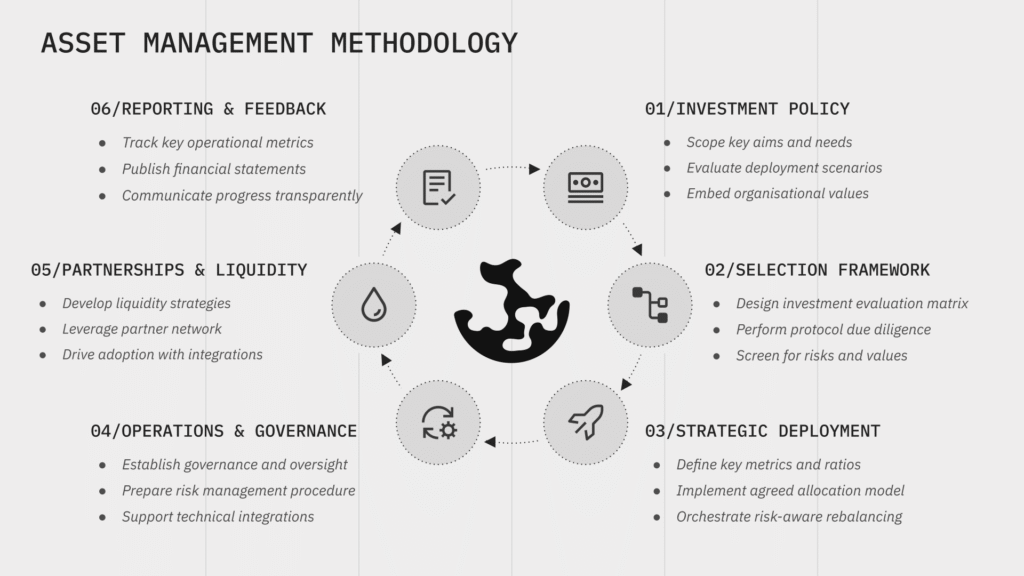

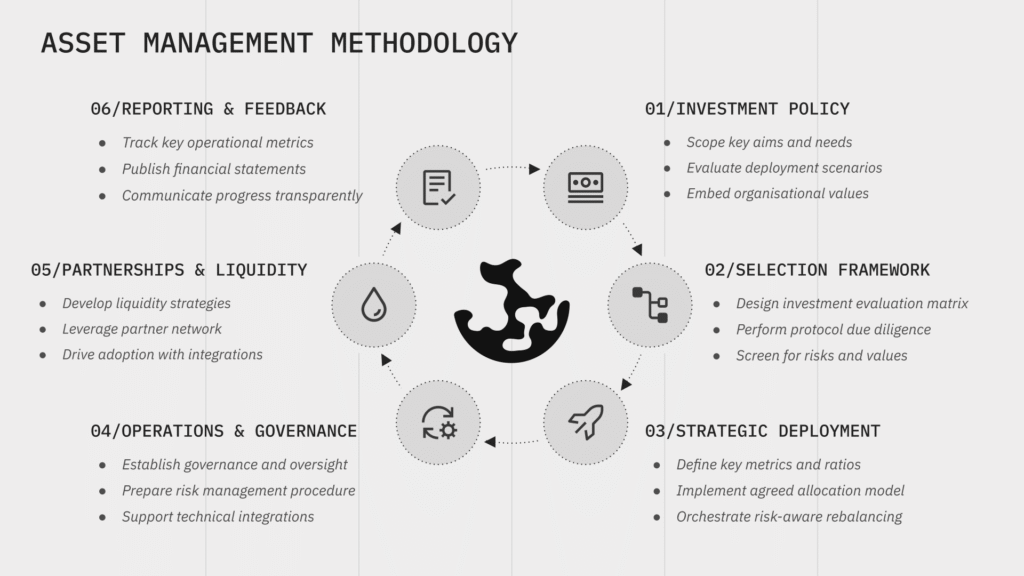

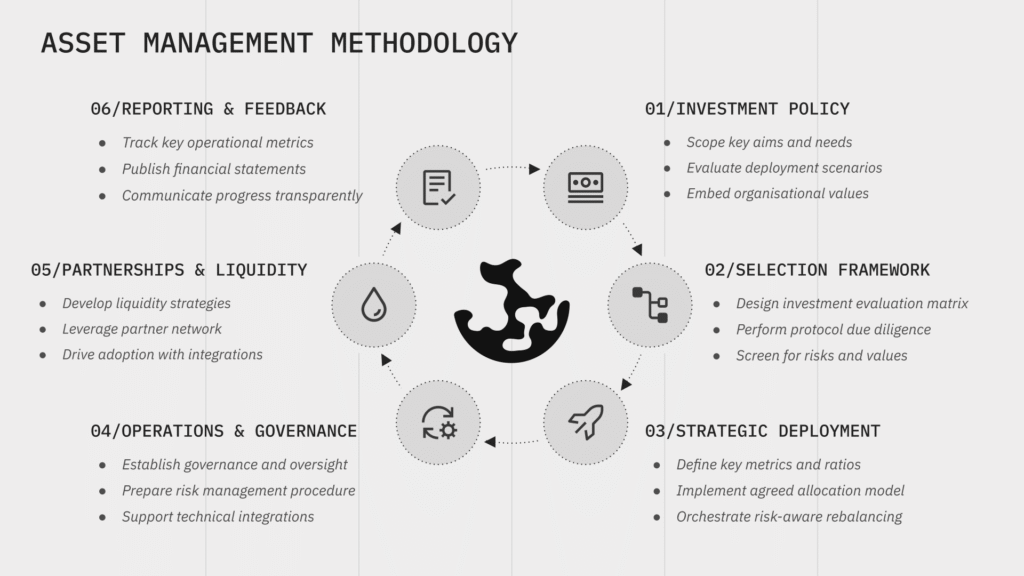

Across the many treasuries we manage, kpk has developed a structured Asset Management Methodology. Sharing this with the EF helped to frame both the policy and the wider capital allocation strategy, grounding them in clarity, control, and accountability.

6-step Asset Management Methodology

Though the EF’s priority was to set policy before allocating more capital, we lobby for investment policies to take into account all stages of the methodology, and be viewed as more than just planning. Ongoing measurement, feedback and iteration are key for policies to remain effective.

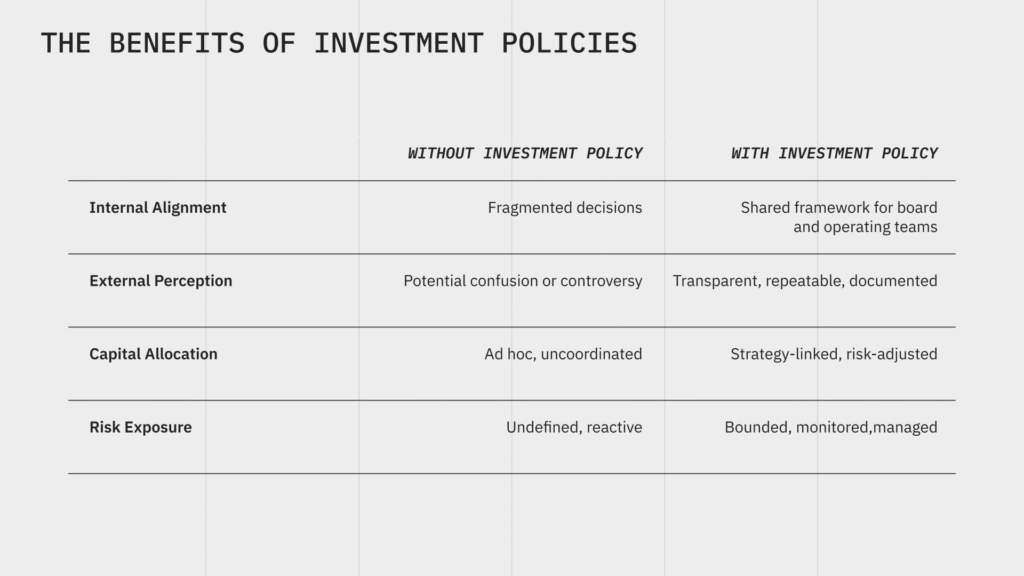

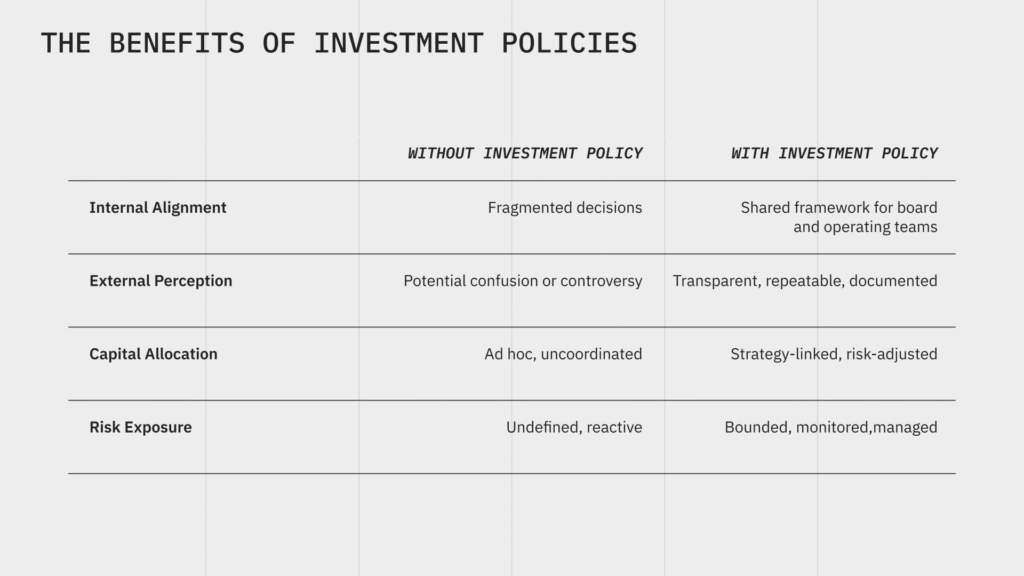

At kpk, we see investment policies as the activation moment for a treasury, through their public commitment to the parameters and principles that will drive the organisation forward. The challenge, then, is ensuring that a clear policy translates into meaningful impact.

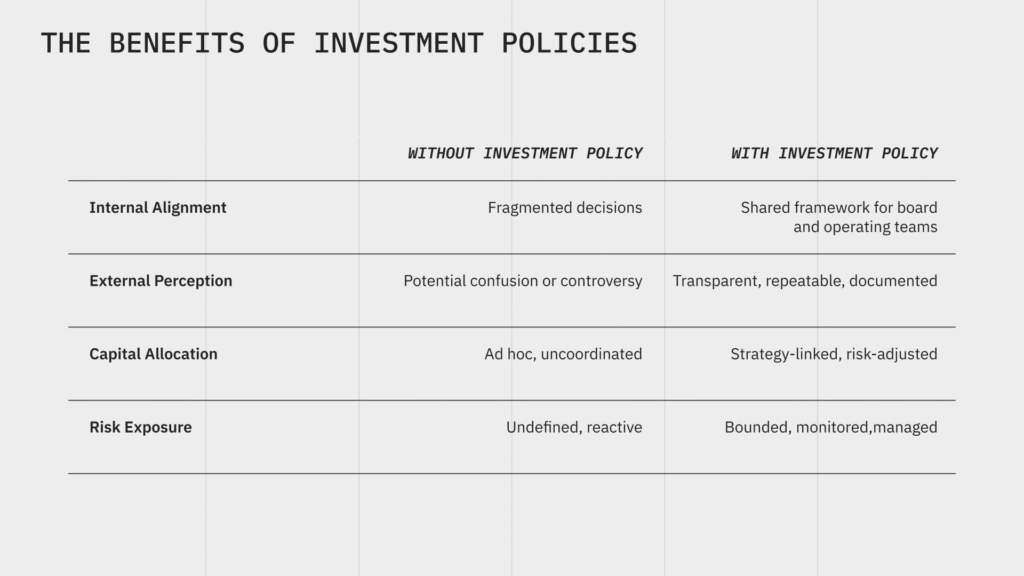

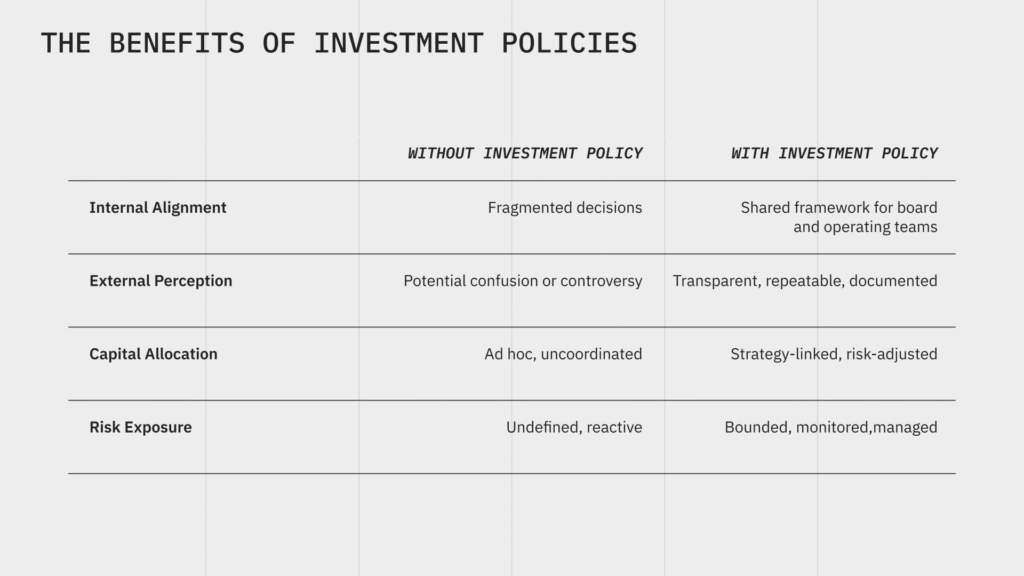

Comparison of Treasury Management (with vs. without) an Investment Policy.

Beyond policy creation, we help to develop and maintain dashboards, reporting and risk alerts, to bring an organisation’s written commitments to life.

Careful Balancing

Arriving at impact requires a careful balance of perspectives and expectations across the organisation’s internal and external stakeholders. It’s an area where experience can make all the difference.

The EF’s Policy seeks to achieve this through the use of clear metrics around its expenditure and runway:

- Targeting operating expenditure of 15% per year to reflect current and recent expenditure.

- Planning for gradual reductions to a future target of 5%, emphasising a renewed focus on sustainability.

- Stipulating a 2.5 year buffer for current expenditure, giving visibility over current timescales, and how the EF thinks about other assets left in reserve.

Our previous work supporting leading DeFi organisations like ENS provided helpful insights into the use of metrics to guide policy. Indicators like target expense ratios, minimum holding thresholds and rebalancing triggers are used by ENS’s endowment to agree clear management expectations.

Together with the ENS community, we worked through a process of simplifying fixed spending commitments into broader targets, to flexibly respond to the changing circumstances of the treasury. Though intuitive metrics often help shared understanding, a careful balance must be struck to avoid overweighting expectations or causing confusion.

To grapple with the challenges of value alignment, we worked with the EF to shape the policy into an actionable filter for investment opportunities. This takes the form of “Defipunk”: a set of core criteria for DeFi that align with Ethereum’s cypherpunk roots. By offering a clear framework for what it means to be aligned, the Policy simultaneously invites engagement and sets a path for meaningful decisions on deploying capital.

Previously, principles-led decisions had constrained the EF from engaging with DeFi. We worked together closely to distill the Policy’s criteria, moving away from abstract values towards practical guidance that encourages engagement.

Ultimately, the EF’s Policy is as much about public perception as technical delivery. By contributing our experience, we helped the EF to arrive at an approach that remains true to its core values whilst conveying a realistic and intuitive understanding of how the EF will embrace DeFi.

Lasting Policy

The EF’s Treasury Policy journey reflects the struggles of many ecosystem foundations and non-profits. Whether you’re a large and sophisticated organisation like the EF or just starting out on your mission, balancing a non-profit structure, strong values and operating constraints with the need for sustainable funding can be a constant challenge.

Treasuries don’t manage themselves. Whether you’re a mission-driven DAO or a long-horizon foundation, the first step is clear: define the rules before deploying capital. That’s what we do at kpk.

If you’re navigating similar questions, whether it’s setting your first policy or refining an existing one we’d be happy to chat. Most orgs we work with start with a short treasury needs assessment.

Related Articles

Towards the Age of Autonomous Vaults

Vault Curation expands kpk’s professional management standards to the broader ecosystem. Discover how agent-powered vaults act within seconds to enhance performance and liquidity, and how the upcoming KPK Rewards Programme will reward real participation.

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Case Study: The Ethereum Foundation’s Treasury Policy

In May 2025, kpk was asked by the Ethereum Foundation to serve as an advisor in the preparation of its long-term investment strategy. This collaboration resulted in the creation and publication of a new Treasury Policy, a key milestone in aligning capital deployment with Ethereum’s values.

Most DAOs and mission-driven treasuries don’t fail because of a lack of funds. They fail from lack of structure. Before chasing returns, what matters is transparency, clarity and alignment. That’s why we begin each onchain asset management process by defining a clear investment policy.

The EF, however, is not just any organisation. Not only is it a strict non-profit with clear operational constraints, it’s a flag-bearer for the virtues of Ethereum.

This case study explores the challenges for foundations and non-profits like the EF in implementing strong investment policies, and some of the best practices and guidance that kpk employed to support this new chapter for Ethereum.

Quote from Hsiao-Wei Wang, Co-Executive Director, Ethereum Foundation

Deploying in DeFi: From Values to Action

The Ethereum Foundation has always played an essential role in supporting research and development for Ethereum’s infrastructure, which in turn is vital for DeFi. In recent months, the connection between the EF and DeFi has changed.

In February, the EF deployed 45,000 Ether from its treasury into several DeFi protocols; signaling to the world its intention to embrace DeFi.

This shift towards DeFi comes at a timely moment for Ethereum’s long-term vision. The EF has recently reset its priorities to focus on improving Ethereum’s user experience and scaling its Layer 1 and blobs. The move into DeFi is another significant milestone in this new era.

However, the EF’s move to embrace DeFi must be balanced against its position as a representative of Ethereum’s values, and one of the most visible onchain treasuries. At the centre of these efforts is the question of how to determine whether investment decisions align with the Ethereum Foundation’s values, as its utmost priority.

And, for ecosystem participants keen to support this move, the question remains: how will the EF clearly and fairly deploy capital into DeFi while ensuring value alignment?

Clear Methodology

Against this context, the EF was faced with a difficult challenge: implementing a policy for investment decisions that resonates not only with their board, finance team and contributors, but with the broader Ethereum community and global financial system at large.

Without clarity over approach, leading organisations like the EF may face criticism over transparency, regulatory risk from overstepping obligations, and even capital loss in the event of poorly-executed investments. Getting all of the necessary stakeholders on the same page is vital for properly mobilising any large non-profit treasury.

Beyond enabling better decisions, a well-crafted investment policy statement can insulate foundations from reputational or legal risks. It provides a clear record of how capital deployment decisions are made, and ensures they remain aligned with the organisation’s mission and scope. As regulatory interest in onchain investment grows, this level of transparency and discipline is becoming increasingly essential.

Across the many treasuries we manage, kpk has developed a structured Asset Management Methodology. Sharing this with the EF helped to frame both the policy and the wider capital allocation strategy, grounding them in clarity, control, and accountability.

6-step Asset Management Methodology

Though the EF’s priority was to set policy before allocating more capital, we lobby for investment policies to take into account all stages of the methodology, and be viewed as more than just planning. Ongoing measurement, feedback and iteration are key for policies to remain effective.

At kpk, we see investment policies as the activation moment for a treasury, through their public commitment to the parameters and principles that will drive the organisation forward. The challenge, then, is ensuring that a clear policy translates into meaningful impact.

Comparison of Treasury Management (with vs. without) an Investment Policy.

Beyond policy creation, we help to develop and maintain dashboards, reporting and risk alerts, to bring an organisation’s written commitments to life.

Careful Balancing

Arriving at impact requires a careful balance of perspectives and expectations across the organisation’s internal and external stakeholders. It’s an area where experience can make all the difference.

The EF’s Policy seeks to achieve this through the use of clear metrics around its expenditure and runway:

- Targeting operating expenditure of 15% per year to reflect current and recent expenditure.

- Planning for gradual reductions to a future target of 5%, emphasising a renewed focus on sustainability.

- Stipulating a 2.5 year buffer for current expenditure, giving visibility over current timescales, and how the EF thinks about other assets left in reserve.

Our previous work supporting leading DeFi organisations like ENS provided helpful insights into the use of metrics to guide policy. Indicators like target expense ratios, minimum holding thresholds and rebalancing triggers are used by ENS’s endowment to agree clear management expectations.

Together with the ENS community, we worked through a process of simplifying fixed spending commitments into broader targets, to flexibly respond to the changing circumstances of the treasury. Though intuitive metrics often help shared understanding, a careful balance must be struck to avoid overweighting expectations or causing confusion.

To grapple with the challenges of value alignment, we worked with the EF to shape the policy into an actionable filter for investment opportunities. This takes the form of “Defipunk”: a set of core criteria for DeFi that align with Ethereum’s cypherpunk roots. By offering a clear framework for what it means to be aligned, the Policy simultaneously invites engagement and sets a path for meaningful decisions on deploying capital.

Previously, principles-led decisions had constrained the EF from engaging with DeFi. We worked together closely to distill the Policy’s criteria, moving away from abstract values towards practical guidance that encourages engagement.

Ultimately, the EF’s Policy is as much about public perception as technical delivery. By contributing our experience, we helped the EF to arrive at an approach that remains true to its core values whilst conveying a realistic and intuitive understanding of how the EF will embrace DeFi.

Lasting Policy

The EF’s Treasury Policy journey reflects the struggles of many ecosystem foundations and non-profits. Whether you’re a large and sophisticated organisation like the EF or just starting out on your mission, balancing a non-profit structure, strong values and operating constraints with the need for sustainable funding can be a constant challenge.

Treasuries don’t manage themselves. Whether you’re a mission-driven DAO or a long-horizon foundation, the first step is clear: define the rules before deploying capital. That’s what we do at kpk.

If you’re navigating similar questions, whether it’s setting your first policy or refining an existing one we’d be happy to chat. Most orgs we work with start with a short treasury needs assessment.

Related Articles

Towards the Age of Autonomous Vaults

Vault Curation expands kpk’s professional management standards to the broader ecosystem. Discover how agent-powered vaults act within seconds to enhance performance and liquidity, and how the upcoming KPK Rewards Programme will reward real participation.

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Case Study: The Ethereum Foundation’s Treasury Policy

In May 2025, kpk was asked by the Ethereum Foundation to serve as an advisor in the preparation of its long-term investment strategy. This collaboration resulted in the creation and publication of a new Treasury Policy, a key milestone in aligning capital deployment with Ethereum’s values.

Most DAOs and mission-driven treasuries don’t fail because of a lack of funds. They fail from lack of structure. Before chasing returns, what matters is transparency, clarity and alignment. That’s why we begin each onchain asset management process by defining a clear investment policy.

The EF, however, is not just any organisation. Not only is it a strict non-profit with clear operational constraints, it’s a flag-bearer for the virtues of Ethereum.

This case study explores the challenges for foundations and non-profits like the EF in implementing strong investment policies, and some of the best practices and guidance that kpk employed to support this new chapter for Ethereum.

Quote from Hsiao-Wei Wang, Co-Executive Director, Ethereum Foundation

Deploying in DeFi: From Values to Action

The Ethereum Foundation has always played an essential role in supporting research and development for Ethereum’s infrastructure, which in turn is vital for DeFi. In recent months, the connection between the EF and DeFi has changed.

In February, the EF deployed 45,000 Ether from its treasury into several DeFi protocols; signaling to the world its intention to embrace DeFi.

This shift towards DeFi comes at a timely moment for Ethereum’s long-term vision. The EF has recently reset its priorities to focus on improving Ethereum’s user experience and scaling its Layer 1 and blobs. The move into DeFi is another significant milestone in this new era.

However, the EF’s move to embrace DeFi must be balanced against its position as a representative of Ethereum’s values, and one of the most visible onchain treasuries. At the centre of these efforts is the question of how to determine whether investment decisions align with the Ethereum Foundation’s values, as its utmost priority.

And, for ecosystem participants keen to support this move, the question remains: how will the EF clearly and fairly deploy capital into DeFi while ensuring value alignment?

Clear Methodology

Against this context, the EF was faced with a difficult challenge: implementing a policy for investment decisions that resonates not only with their board, finance team and contributors, but with the broader Ethereum community and global financial system at large.

Without clarity over approach, leading organisations like the EF may face criticism over transparency, regulatory risk from overstepping obligations, and even capital loss in the event of poorly-executed investments. Getting all of the necessary stakeholders on the same page is vital for properly mobilising any large non-profit treasury.

Beyond enabling better decisions, a well-crafted investment policy statement can insulate foundations from reputational or legal risks. It provides a clear record of how capital deployment decisions are made, and ensures they remain aligned with the organisation’s mission and scope. As regulatory interest in onchain investment grows, this level of transparency and discipline is becoming increasingly essential.

Across the many treasuries we manage, kpk has developed a structured Asset Management Methodology. Sharing this with the EF helped to frame both the policy and the wider capital allocation strategy, grounding them in clarity, control, and accountability.

6-step Asset Management Methodology

Though the EF’s priority was to set policy before allocating more capital, we lobby for investment policies to take into account all stages of the methodology, and be viewed as more than just planning. Ongoing measurement, feedback and iteration are key for policies to remain effective.

At kpk, we see investment policies as the activation moment for a treasury, through their public commitment to the parameters and principles that will drive the organisation forward. The challenge, then, is ensuring that a clear policy translates into meaningful impact.

Comparison of Treasury Management (with vs. without) an Investment Policy.

Beyond policy creation, we help to develop and maintain dashboards, reporting and risk alerts, to bring an organisation’s written commitments to life.

Careful Balancing

Arriving at impact requires a careful balance of perspectives and expectations across the organisation’s internal and external stakeholders. It’s an area where experience can make all the difference.

The EF’s Policy seeks to achieve this through the use of clear metrics around its expenditure and runway:

- Targeting operating expenditure of 15% per year to reflect current and recent expenditure.

- Planning for gradual reductions to a future target of 5%, emphasising a renewed focus on sustainability.

- Stipulating a 2.5 year buffer for current expenditure, giving visibility over current timescales, and how the EF thinks about other assets left in reserve.

Our previous work supporting leading DeFi organisations like ENS provided helpful insights into the use of metrics to guide policy. Indicators like target expense ratios, minimum holding thresholds and rebalancing triggers are used by ENS’s endowment to agree clear management expectations.

Together with the ENS community, we worked through a process of simplifying fixed spending commitments into broader targets, to flexibly respond to the changing circumstances of the treasury. Though intuitive metrics often help shared understanding, a careful balance must be struck to avoid overweighting expectations or causing confusion.

To grapple with the challenges of value alignment, we worked with the EF to shape the policy into an actionable filter for investment opportunities. This takes the form of “Defipunk”: a set of core criteria for DeFi that align with Ethereum’s cypherpunk roots. By offering a clear framework for what it means to be aligned, the Policy simultaneously invites engagement and sets a path for meaningful decisions on deploying capital.

Previously, principles-led decisions had constrained the EF from engaging with DeFi. We worked together closely to distill the Policy’s criteria, moving away from abstract values towards practical guidance that encourages engagement.

Ultimately, the EF’s Policy is as much about public perception as technical delivery. By contributing our experience, we helped the EF to arrive at an approach that remains true to its core values whilst conveying a realistic and intuitive understanding of how the EF will embrace DeFi.

Lasting Policy

The EF’s Treasury Policy journey reflects the struggles of many ecosystem foundations and non-profits. Whether you’re a large and sophisticated organisation like the EF or just starting out on your mission, balancing a non-profit structure, strong values and operating constraints with the need for sustainable funding can be a constant challenge.

Treasuries don’t manage themselves. Whether you’re a mission-driven DAO or a long-horizon foundation, the first step is clear: define the rules before deploying capital. That’s what we do at kpk.

If you’re navigating similar questions, whether it’s setting your first policy or refining an existing one we’d be happy to chat. Most orgs we work with start with a short treasury needs assessment.

Related Articles

Case Study: The Ethereum Foundation’s Treasury Policy

In May 2025, kpk was asked by the Ethereum Foundation to serve as an advisor in the preparation of its long-term investment strategy. This collaboration resulted in the creation and publication of a new Treasury Policy, a key milestone in aligning capital deployment with Ethereum’s values.

Most DAOs and mission-driven treasuries don’t fail because of a lack of funds. They fail from lack of structure. Before chasing returns, what matters is transparency, clarity and alignment. That’s why we begin each onchain asset management process by defining a clear investment policy.

The EF, however, is not just any organisation. Not only is it a strict non-profit with clear operational constraints, it’s a flag-bearer for the virtues of Ethereum.

This case study explores the challenges for foundations and non-profits like the EF in implementing strong investment policies, and some of the best practices and guidance that kpk employed to support this new chapter for Ethereum.

Quote from Hsiao-Wei Wang, Co-Executive Director, Ethereum Foundation

Deploying in DeFi: From Values to Action

The Ethereum Foundation has always played an essential role in supporting research and development for Ethereum’s infrastructure, which in turn is vital for DeFi. In recent months, the connection between the EF and DeFi has changed.

In February, the EF deployed 45,000 Ether from its treasury into several DeFi protocols; signaling to the world its intention to embrace DeFi.

This shift towards DeFi comes at a timely moment for Ethereum’s long-term vision. The EF has recently reset its priorities to focus on improving Ethereum’s user experience and scaling its Layer 1 and blobs. The move into DeFi is another significant milestone in this new era.

However, the EF’s move to embrace DeFi must be balanced against its position as a representative of Ethereum’s values, and one of the most visible onchain treasuries. At the centre of these efforts is the question of how to determine whether investment decisions align with the Ethereum Foundation’s values, as its utmost priority.

And, for ecosystem participants keen to support this move, the question remains: how will the EF clearly and fairly deploy capital into DeFi while ensuring value alignment?

Clear Methodology

Against this context, the EF was faced with a difficult challenge: implementing a policy for investment decisions that resonates not only with their board, finance team and contributors, but with the broader Ethereum community and global financial system at large.

Without clarity over approach, leading organisations like the EF may face criticism over transparency, regulatory risk from overstepping obligations, and even capital loss in the event of poorly-executed investments. Getting all of the necessary stakeholders on the same page is vital for properly mobilising any large non-profit treasury.

Beyond enabling better decisions, a well-crafted investment policy statement can insulate foundations from reputational or legal risks. It provides a clear record of how capital deployment decisions are made, and ensures they remain aligned with the organisation’s mission and scope. As regulatory interest in onchain investment grows, this level of transparency and discipline is becoming increasingly essential.

Across the many treasuries we manage, kpk has developed a structured Asset Management Methodology. Sharing this with the EF helped to frame both the policy and the wider capital allocation strategy, grounding them in clarity, control, and accountability.

6-step Asset Management Methodology

Though the EF’s priority was to set policy before allocating more capital, we lobby for investment policies to take into account all stages of the methodology, and be viewed as more than just planning. Ongoing measurement, feedback and iteration are key for policies to remain effective.

At kpk, we see investment policies as the activation moment for a treasury, through their public commitment to the parameters and principles that will drive the organisation forward. The challenge, then, is ensuring that a clear policy translates into meaningful impact.

Comparison of Treasury Management (with vs. without) an Investment Policy.

Beyond policy creation, we help to develop and maintain dashboards, reporting and risk alerts, to bring an organisation’s written commitments to life.

Careful Balancing

Arriving at impact requires a careful balance of perspectives and expectations across the organisation’s internal and external stakeholders. It’s an area where experience can make all the difference.

The EF’s Policy seeks to achieve this through the use of clear metrics around its expenditure and runway:

- Targeting operating expenditure of 15% per year to reflect current and recent expenditure.

- Planning for gradual reductions to a future target of 5%, emphasising a renewed focus on sustainability.

- Stipulating a 2.5 year buffer for current expenditure, giving visibility over current timescales, and how the EF thinks about other assets left in reserve.

Our previous work supporting leading DeFi organisations like ENS provided helpful insights into the use of metrics to guide policy. Indicators like target expense ratios, minimum holding thresholds and rebalancing triggers are used by ENS’s endowment to agree clear management expectations.

Together with the ENS community, we worked through a process of simplifying fixed spending commitments into broader targets, to flexibly respond to the changing circumstances of the treasury. Though intuitive metrics often help shared understanding, a careful balance must be struck to avoid overweighting expectations or causing confusion.

To grapple with the challenges of value alignment, we worked with the EF to shape the policy into an actionable filter for investment opportunities. This takes the form of “Defipunk”: a set of core criteria for DeFi that align with Ethereum’s cypherpunk roots. By offering a clear framework for what it means to be aligned, the Policy simultaneously invites engagement and sets a path for meaningful decisions on deploying capital.

Previously, principles-led decisions had constrained the EF from engaging with DeFi. We worked together closely to distill the Policy’s criteria, moving away from abstract values towards practical guidance that encourages engagement.

Ultimately, the EF’s Policy is as much about public perception as technical delivery. By contributing our experience, we helped the EF to arrive at an approach that remains true to its core values whilst conveying a realistic and intuitive understanding of how the EF will embrace DeFi.

Lasting Policy

The EF’s Treasury Policy journey reflects the struggles of many ecosystem foundations and non-profits. Whether you’re a large and sophisticated organisation like the EF or just starting out on your mission, balancing a non-profit structure, strong values and operating constraints with the need for sustainable funding can be a constant challenge.

Treasuries don’t manage themselves. Whether you’re a mission-driven DAO or a long-horizon foundation, the first step is clear: define the rules before deploying capital. That’s what we do at kpk.

If you’re navigating similar questions, whether it’s setting your first policy or refining an existing one we’d be happy to chat. Most orgs we work with start with a short treasury needs assessment.