Onchain Investment Vehicles: Open Finance’s Connective Tissue

DeFi is no longer just a playground for crypto natives—it’s rapidly becoming the backend infrastructure for traditional finance. From mutual funds to mainstream apps like Robinhood and PayPal, DeFi primitives are powering stablecoin transfers, yield products, and tokenised asset access for millions of users worldwide.

Despite this progress, DeFi still lacks the connective tissue to bring together its individual technological innovations. However, as the composability and transparency of DeFi collide with the distribution scale of fintech, we foresee the emergence of a connected, hybrid financial system—programmable, global, and open by default.

These integrations have already been taking place through individual protocol initiatives, but we expect the same digital market forces that aggregated industries like Media, Transportation, Finance, Retail, and Hospitality will play out in the long term. That is to say, services which aggregate different options will naturally consolidate the many individual solutions, drive value back to users, and come to define digital asset markets.

For now, though, DeFi remains a very complex system to navigate. Such an aggregation layer could only be successfully deployed by experienced actors—ones who survived multiple market cycles through thorough risk management practices. We think there’s a massive opportunity to become the gateway to DeFi. We believe kpk is uniquely positioned to grab it.

We’ve been managing $2B+ in onchain treasury assets for the most reputable DeFi DAOs in existence. At a time where DAO treasury execution was either managed through ossified governance cycles or anonymous multi-sigs, we’ve pioneered non-custodial asset management using the Zodiac Standard to dynamically execute a set of pre-approved payloads on behalf of our clients.

This strategy has proven successful, as it allowed us to quickly deploy a wide range of DeFi strategies in a market fraught with ephemeral yield opportunities. Granular policy implementations through our Permissions Layer technologies allowed us to automate most of our execution operations, increasing capital efficiency through compounding and lower collateral ratios protected by position rebalancing.

Managing bespoke portfolios has proved extremely valuable for our clients—but required dedicated setups and teams to operate—which ultimately prevented us from managing smaller treasuries. After spending the last 5 years deploying capital on-chain without any lost funds, we’re now building on our battle-tested infrastructure to allow any eligible investor to participate in multiple thematic portfolios.

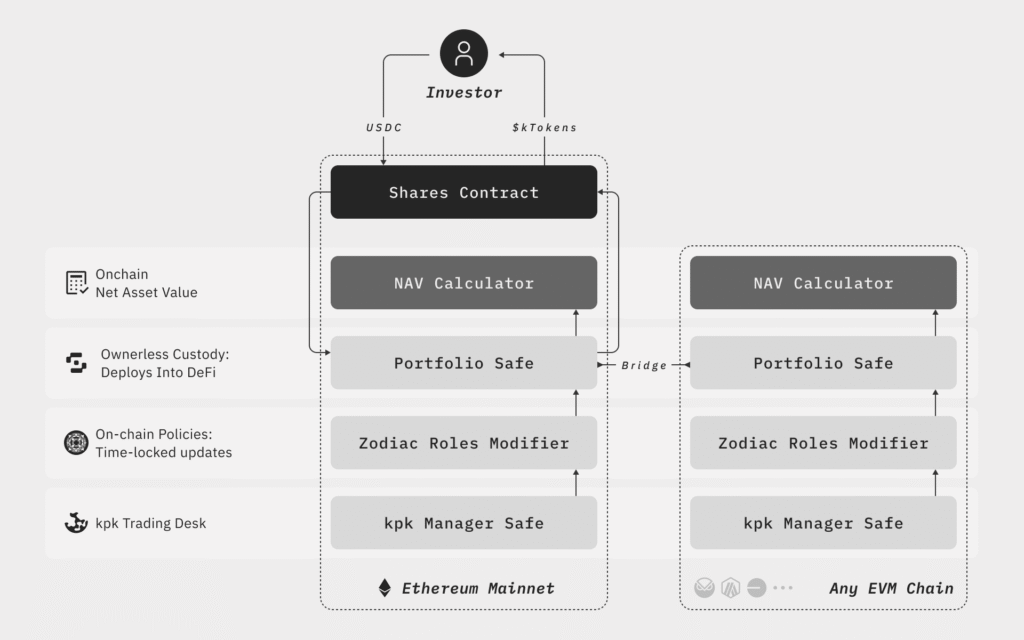

We’re calling them “onchain investment vehicles” or “OIVs”. You can think of them as a connective fabric that weaves together a variety of product choices from across the DeFi ecosystem into a single, attractive interface for every kind of user.

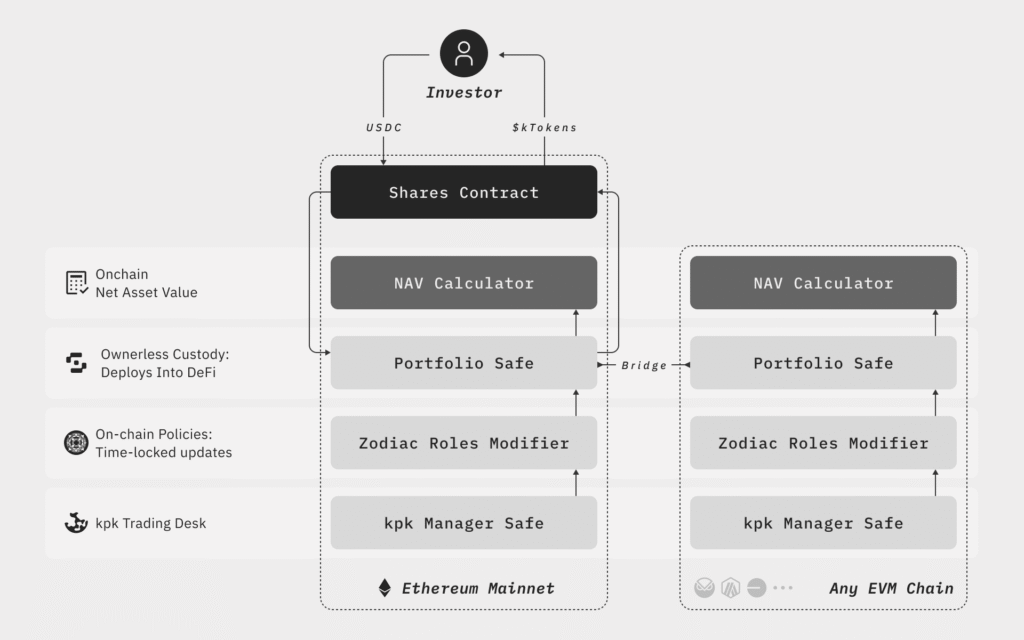

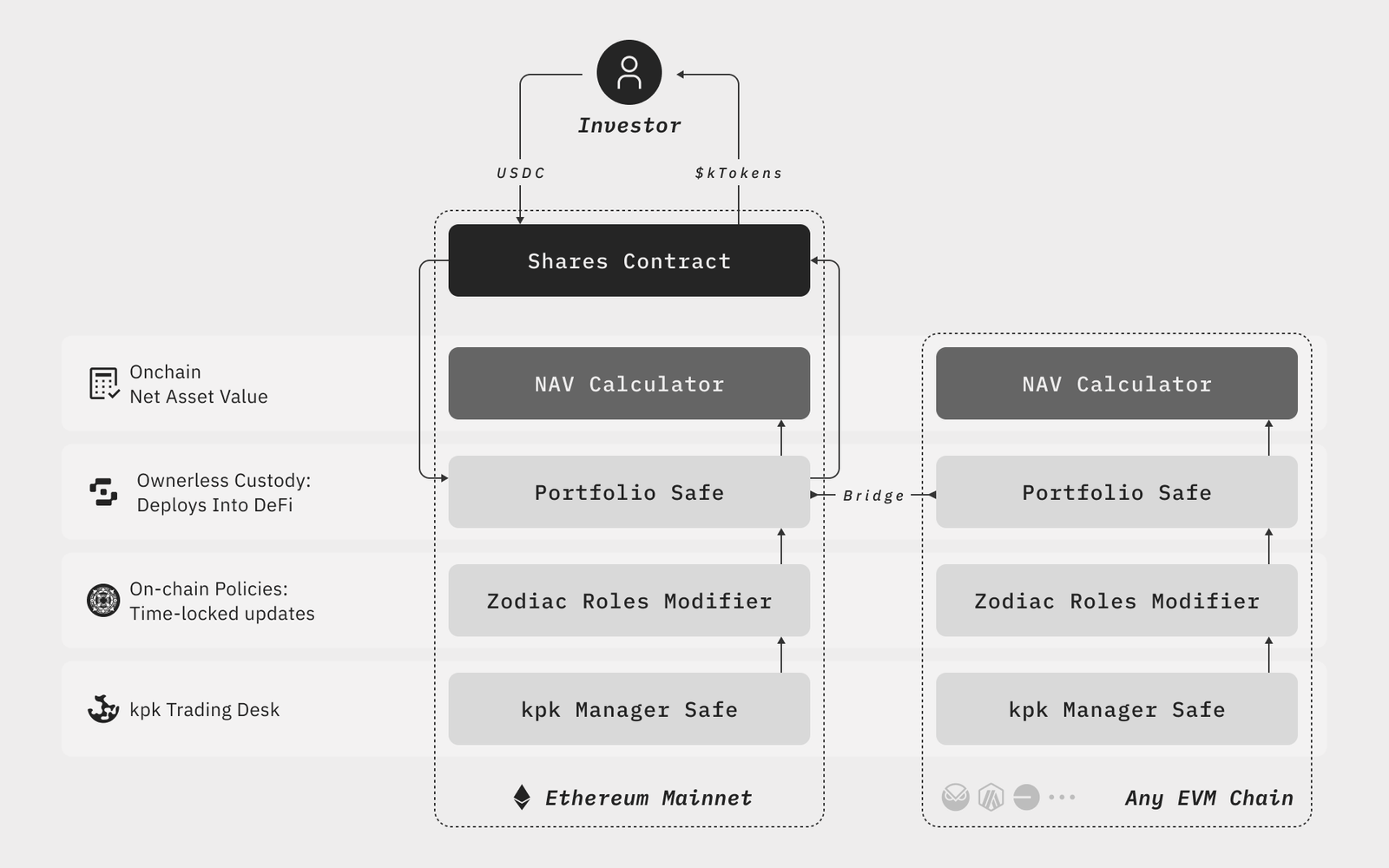

We’re doing this by adding a tokenisation layer on top of a set of Safe accounts deployed on multiple chains, which allow any eligible investor to subscribe by buying an ERC20 representing a share of the underlying net asset value (NAV). Contrary to other multi-chain yield aggregation products out there, we’re exposing portfolio NAVs on-chain through a set of smart contracts that use balance and price oracles to accurately calculate the value in each block. This modular architecture allows us to scale protocol support and quickly adapt to market opportunities.

Built with a business-to-business-to-consumer distribution in mind, our OIVs can easily be integrated by:

- Centralised Exchanges, changing the once opaque stablecoin yield offer with an open and sustainable alternative;

- Wallets, offering a simple way for their users to generate a return on their holdings;

- Custodians, exposing their institutional client base to DeFi yields; and even; and

- Private Placement Funds, which can be mandated to acquire yield-bearing OIV tokens.

As financial infrastructure evolves, the ability to integrate decentralised systems into accessible, reliable products will define long-term relevance. DeFi has proven its potential, but it remains fragmented and operationally complex.

At kpk, we’re not just building yield products—we’re building the connective tissue of open finance.

Stay tuned.

Disclaimer

The OIVs may not be available to certain persons or in certain jurisdictions, and the availability of the OIVs may be limited in your jurisdiction. The OIVs are not registered with, or approved by, any financial or regulatory authority and do not constitute an investment fund, securities business, or virtual asset service provider. Nothing in this article constitutes, or should be taken as, an offer to sell, a solicitation of an offer to buy, or a recommendation to engage in any investment activity.

The information provided is for general informational purposes only and may be updated or amended at any time without notice. It does not constitute financial, legal, tax, or other professional advice. You should consult with your professional advisers before making any decisions.

Participation in crypto-assets, including through the OIVs, involves significant risk, including high volatility and the potential loss of your entire investment. Returns are not guaranteed. You should conduct research and due diligence before engaging in any crypto-asset activity.

Related Articles

Towards the Age of Autonomous Vaults

Vault Curation expands kpk’s professional management standards to the broader ecosystem. Discover how agent-powered vaults act within seconds to enhance performance and liquidity, and how the upcoming KPK Rewards Programme will reward real participation.

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Onchain Investment Vehicles: Open Finance’s Connective Tissue

DeFi is no longer just a playground for crypto natives—it’s rapidly becoming the backend infrastructure for traditional finance. From mutual funds to mainstream apps like Robinhood and PayPal, DeFi primitives are powering stablecoin transfers, yield products, and tokenised asset access for millions of users worldwide.

Despite this progress, DeFi still lacks the connective tissue to bring together its individual technological innovations. However, as the composability and transparency of DeFi collide with the distribution scale of fintech, we foresee the emergence of a connected, hybrid financial system—programmable, global, and open by default.

These integrations have already been taking place through individual protocol initiatives, but we expect the same digital market forces that aggregated industries like Media, Transportation, Finance, Retail, and Hospitality will play out in the long term. That is to say, services which aggregate different options will naturally consolidate the many individual solutions, drive value back to users, and come to define digital asset markets.

For now, though, DeFi remains a very complex system to navigate. Such an aggregation layer could only be successfully deployed by experienced actors—ones who survived multiple market cycles through thorough risk management practices. We think there’s a massive opportunity to become the gateway to DeFi. We believe kpk is uniquely positioned to grab it.

We’ve been managing $2B+ in onchain treasury assets for the most reputable DeFi DAOs in existence. At a time where DAO treasury execution was either managed through ossified governance cycles or anonymous multi-sigs, we’ve pioneered non-custodial asset management using the Zodiac Standard to dynamically execute a set of pre-approved payloads on behalf of our clients.

This strategy has proven successful, as it allowed us to quickly deploy a wide range of DeFi strategies in a market fraught with ephemeral yield opportunities. Granular policy implementations through our Permissions Layer technologies allowed us to automate most of our execution operations, increasing capital efficiency through compounding and lower collateral ratios protected by position rebalancing.

Managing bespoke portfolios has proved extremely valuable for our clients—but required dedicated setups and teams to operate—which ultimately prevented us from managing smaller treasuries. After spending the last 5 years deploying capital on-chain without any lost funds, we’re now building on our battle-tested infrastructure to allow any eligible investor to participate in multiple thematic portfolios.

We’re calling them “onchain investment vehicles” or “OIVs”. You can think of them as a connective fabric that weaves together a variety of product choices from across the DeFi ecosystem into a single, attractive interface for every kind of user.

We’re doing this by adding a tokenisation layer on top of a set of Safe accounts deployed on multiple chains, which allow any eligible investor to subscribe by buying an ERC20 representing a share of the underlying net asset value (NAV). Contrary to other multi-chain yield aggregation products out there, we’re exposing portfolio NAVs on-chain through a set of smart contracts that use balance and price oracles to accurately calculate the value in each block. This modular architecture allows us to scale protocol support and quickly adapt to market opportunities.

Built with a business-to-business-to-consumer distribution in mind, our OIVs can easily be integrated by:

- Centralised Exchanges, changing the once opaque stablecoin yield offer with an open and sustainable alternative;

- Wallets, offering a simple way for their users to generate a return on their holdings;

- Custodians, exposing their institutional client base to DeFi yields; and even; and

- Private Placement Funds, which can be mandated to acquire yield-bearing OIV tokens.

As financial infrastructure evolves, the ability to integrate decentralised systems into accessible, reliable products will define long-term relevance. DeFi has proven its potential, but it remains fragmented and operationally complex.

At kpk, we’re not just building yield products—we’re building the connective tissue of open finance.

Stay tuned.

Disclaimer

The OIVs may not be available to certain persons or in certain jurisdictions, and the availability of the OIVs may be limited in your jurisdiction. The OIVs are not registered with, or approved by, any financial or regulatory authority and do not constitute an investment fund, securities business, or virtual asset service provider. Nothing in this article constitutes, or should be taken as, an offer to sell, a solicitation of an offer to buy, or a recommendation to engage in any investment activity.

The information provided is for general informational purposes only and may be updated or amended at any time without notice. It does not constitute financial, legal, tax, or other professional advice. You should consult with your professional advisers before making any decisions.

Participation in crypto-assets, including through the OIVs, involves significant risk, including high volatility and the potential loss of your entire investment. Returns are not guaranteed. You should conduct research and due diligence before engaging in any crypto-asset activity.

Related Articles

Towards the Age of Autonomous Vaults

Vault Curation expands kpk’s professional management standards to the broader ecosystem. Discover how agent-powered vaults act within seconds to enhance performance and liquidity, and how the upcoming KPK Rewards Programme will reward real participation.

Curated Markets on Gearbox: Scaling Onchain Asset Management

Explore kpk-curated ETH Earn Pools on Gearbox, bringing structured frameworks, continuous monitoring, and risk-adjusted yield opportunities to permissionless lending.

USD Prime Fund

The USD Prime Fund uses structured frameworks and autonomous agents to deliver sustainable yields at lower costs.

Onchain Investment Vehicles: Open Finance’s Connective Tissue

DeFi is no longer just a playground for crypto natives—it’s rapidly becoming the backend infrastructure for traditional finance. From mutual funds to mainstream apps like Robinhood and PayPal, DeFi primitives are powering stablecoin transfers, yield products, and tokenised asset access for millions of users worldwide.

Despite this progress, DeFi still lacks the connective tissue to bring together its individual technological innovations. However, as the composability and transparency of DeFi collide with the distribution scale of fintech, we foresee the emergence of a connected, hybrid financial system—programmable, global, and open by default.

These integrations have already been taking place through individual protocol initiatives, but we expect the same digital market forces that aggregated industries like Media, Transportation, Finance, Retail, and Hospitality will play out in the long term. That is to say, services which aggregate different options will naturally consolidate the many individual solutions, drive value back to users, and come to define digital asset markets.

For now, though, DeFi remains a very complex system to navigate. Such an aggregation layer could only be successfully deployed by experienced actors—ones who survived multiple market cycles through thorough risk management practices. We think there’s a massive opportunity to become the gateway to DeFi. We believe kpk is uniquely positioned to grab it.

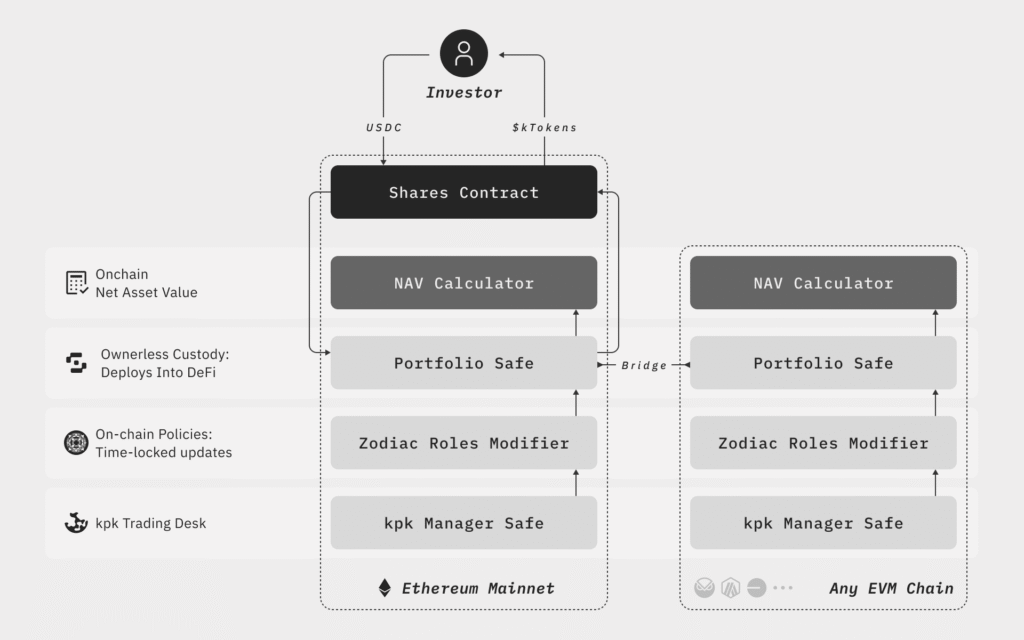

We’ve been managing $2B+ in onchain treasury assets for the most reputable DeFi DAOs in existence. At a time where DAO treasury execution was either managed through ossified governance cycles or anonymous multi-sigs, we’ve pioneered non-custodial asset management using the Zodiac Standard to dynamically execute a set of pre-approved payloads on behalf of our clients.

This strategy has proven successful, as it allowed us to quickly deploy a wide range of DeFi strategies in a market fraught with ephemeral yield opportunities. Granular policy implementations through our Permissions Layer technologies allowed us to automate most of our execution operations, increasing capital efficiency through compounding and lower collateral ratios protected by position rebalancing.

Managing bespoke portfolios has proved extremely valuable for our clients—but required dedicated setups and teams to operate—which ultimately prevented us from managing smaller treasuries. After spending the last 5 years deploying capital on-chain without any lost funds, we’re now building on our battle-tested infrastructure to allow any eligible investor to participate in multiple thematic portfolios.

We’re calling them “onchain investment vehicles” or “OIVs”. You can think of them as a connective fabric that weaves together a variety of product choices from across the DeFi ecosystem into a single, attractive interface for every kind of user.

We’re doing this by adding a tokenisation layer on top of a set of Safe accounts deployed on multiple chains, which allow any eligible investor to subscribe by buying an ERC20 representing a share of the underlying net asset value (NAV). Contrary to other multi-chain yield aggregation products out there, we’re exposing portfolio NAVs on-chain through a set of smart contracts that use balance and price oracles to accurately calculate the value in each block. This modular architecture allows us to scale protocol support and quickly adapt to market opportunities.

Built with a business-to-business-to-consumer distribution in mind, our OIVs can easily be integrated by:

- Centralised Exchanges, changing the once opaque stablecoin yield offer with an open and sustainable alternative;

- Wallets, offering a simple way for their users to generate a return on their holdings;

- Custodians, exposing their institutional client base to DeFi yields; and even; and

- Private Placement Funds, which can be mandated to acquire yield-bearing OIV tokens.

As financial infrastructure evolves, the ability to integrate decentralised systems into accessible, reliable products will define long-term relevance. DeFi has proven its potential, but it remains fragmented and operationally complex.

At kpk, we’re not just building yield products—we’re building the connective tissue of open finance.

Stay tuned.

Disclaimer

The OIVs may not be available to certain persons or in certain jurisdictions, and the availability of the OIVs may be limited in your jurisdiction. The OIVs are not registered with, or approved by, any financial or regulatory authority and do not constitute an investment fund, securities business, or virtual asset service provider. Nothing in this article constitutes, or should be taken as, an offer to sell, a solicitation of an offer to buy, or a recommendation to engage in any investment activity.

The information provided is for general informational purposes only and may be updated or amended at any time without notice. It does not constitute financial, legal, tax, or other professional advice. You should consult with your professional advisers before making any decisions.

Participation in crypto-assets, including through the OIVs, involves significant risk, including high volatility and the potential loss of your entire investment. Returns are not guaranteed. You should conduct research and due diligence before engaging in any crypto-asset activity.

Related Articles

Onchain Investment Vehicles: Open Finance’s Connective Tissue

DeFi is no longer just a playground for crypto natives—it’s rapidly becoming the backend infrastructure for traditional finance. From mutual funds to mainstream apps like Robinhood and PayPal, DeFi primitives are powering stablecoin transfers, yield products, and tokenised asset access for millions of users worldwide.

Despite this progress, DeFi still lacks the connective tissue to bring together its individual technological innovations. However, as the composability and transparency of DeFi collide with the distribution scale of fintech, we foresee the emergence of a connected, hybrid financial system—programmable, global, and open by default.

These integrations have already been taking place through individual protocol initiatives, but we expect the same digital market forces that aggregated industries like Media, Transportation, Finance, Retail, and Hospitality will play out in the long term. That is to say, services which aggregate different options will naturally consolidate the many individual solutions, drive value back to users, and come to define digital asset markets.

For now, though, DeFi remains a very complex system to navigate. Such an aggregation layer could only be successfully deployed by experienced actors—ones who survived multiple market cycles through thorough risk management practices. We think there’s a massive opportunity to become the gateway to DeFi. We believe kpk is uniquely positioned to grab it.

We’ve been managing $2B+ in onchain treasury assets for the most reputable DeFi DAOs in existence. At a time where DAO treasury execution was either managed through ossified governance cycles or anonymous multi-sigs, we’ve pioneered non-custodial asset management using the Zodiac Standard to dynamically execute a set of pre-approved payloads on behalf of our clients.

This strategy has proven successful, as it allowed us to quickly deploy a wide range of DeFi strategies in a market fraught with ephemeral yield opportunities. Granular policy implementations through our Permissions Layer technologies allowed us to automate most of our execution operations, increasing capital efficiency through compounding and lower collateral ratios protected by position rebalancing.

Managing bespoke portfolios has proved extremely valuable for our clients—but required dedicated setups and teams to operate—which ultimately prevented us from managing smaller treasuries. After spending the last 5 years deploying capital on-chain without any lost funds, we’re now building on our battle-tested infrastructure to allow any eligible investor to participate in multiple thematic portfolios.

We’re calling them “onchain investment vehicles” or “OIVs”. You can think of them as a connective fabric that weaves together a variety of product choices from across the DeFi ecosystem into a single, attractive interface for every kind of user.

We’re doing this by adding a tokenisation layer on top of a set of Safe accounts deployed on multiple chains, which allow any eligible investor to subscribe by buying an ERC20 representing a share of the underlying net asset value (NAV). Contrary to other multi-chain yield aggregation products out there, we’re exposing portfolio NAVs on-chain through a set of smart contracts that use balance and price oracles to accurately calculate the value in each block. This modular architecture allows us to scale protocol support and quickly adapt to market opportunities.

Built with a business-to-business-to-consumer distribution in mind, our OIVs can easily be integrated by:

- Centralised Exchanges, changing the once opaque stablecoin yield offer with an open and sustainable alternative;

- Wallets, offering a simple way for their users to generate a return on their holdings;

- Custodians, exposing their institutional client base to DeFi yields; and even; and

- Private Placement Funds, which can be mandated to acquire yield-bearing OIV tokens.

As financial infrastructure evolves, the ability to integrate decentralised systems into accessible, reliable products will define long-term relevance. DeFi has proven its potential, but it remains fragmented and operationally complex.

At kpk, we’re not just building yield products—we’re building the connective tissue of open finance.

Stay tuned.

Disclaimer

The OIVs may not be available to certain persons or in certain jurisdictions, and the availability of the OIVs may be limited in your jurisdiction. The OIVs are not registered with, or approved by, any financial or regulatory authority and do not constitute an investment fund, securities business, or virtual asset service provider. Nothing in this article constitutes, or should be taken as, an offer to sell, a solicitation of an offer to buy, or a recommendation to engage in any investment activity.

The information provided is for general informational purposes only and may be updated or amended at any time without notice. It does not constitute financial, legal, tax, or other professional advice. You should consult with your professional advisers before making any decisions.

Participation in crypto-assets, including through the OIVs, involves significant risk, including high volatility and the potential loss of your entire investment. Returns are not guaranteed. You should conduct research and due diligence before engaging in any crypto-asset activity.